Collaborative Selling

A couple of months back, one of our sales reps did something during our weekly All-Hands Meeting (we at Avoma call it “All Minds”) that sparked an interesting discourse across our internal teams.

He started giving “shoutouts” to colleagues from the product, marketing, and customer success team for helping him close a deal. Nothing surprising here, right?

It’s perfectly normal for sales to thank colleagues from other teams—except that we noticed that it was becoming increasingly normal for people across the board to come together whenever there was an opportunity to get a deal across the table.

For a long time now, we at Avoma have been discussing this natural partnership that emerges between sales and non-sales teams when it comes to the subject of closing a deal. In fact, we believe in this concept of collective labor so much that our CEO recently wrote an entire ebook on the topic called The Collaborative Selling Handbook.

It’s a nice 60-page read that puts a lot of things in perspective for you even if you are not directly in sales. You should read it

But back to the topic, we sincerely believe that it takes a village to close deals and we think that it’s an idea that has the potential to change the way your business approaches selling. For what it’s worth, you might already be practicing collaborative selling even if you were not aware of the concept so far (just like we did at Avoma).

Therefore, it’s worth acknowledging something that might already be happening plus has the power to improve your win rate the moment you systematize it. This blog is a primer on what collaborative selling is and how you can leverage it to your business advantage.

What is collaborative selling?

The old definition of collaborative selling was only focused on working together with customers to close a deal. A lot of times, new prospects approach us and ask if we can share with us recommendations from your existing customers. That is, indeed, an exemplary form of collaboration that takes place with prospects and customers.

However, it’s a somewhat limiting definition if you leave out other collaborators in the process.

Yes, customers are an integral part of collaborative selling. But so are people from the marketing, product, customer success, customer service, legal, and even HR team who rally behind the sales team to help them get through each deal.

Taking this into consideration, it makes sense to come up with a more inclusive definition of collaborative selling:

“Collaborative selling is a process of working with collaborators on both sides of the fence to identify the optimal solution for the customers.”

Collaborative selling also shares its DNA with the concept of “team selling” that most people are already familiar with. Team selling is a pretty popular concept in B2B sales—especially in industries that witness long and complex sales cycles or the nuances of impressing the enterprise buying committees.

It takes place when companies form a team—sort of like a special sales task force—to close deals instead of leaving it in the hands of a single sales rep—especially when the stakes are too high. The nuance here is that team selling is limited only to collaboration within the sales team. Again, it’s somewhat of an oxymoron to speak of collaboration and limit it within the confines of just one team.

Collaborative selling is not just collaboration between your sales and customers but a dance ritual between other individuals and teams involved on the buyer side as well as the seller side.

It’s much more meaningful to combine the concepts of collaborating with the customers or the sales team and expand the definition to include collaboration with other stakeholders who play an equally critical role in closing a deal.

What can collaborative selling do for you?

Selling becomes faster when your product is of better quality, when your messaging is clear, and you have sales-ready collateral that reps can use during their customer conversations.

Selling becomes easier when your customer success team is clear about what use cases their product supports and they have the right case studies to show to the customers.

The point is that everything is easier and faster when people have the right mindset around collaboration rather than assuming that individuals are responsible for selling. Let’s look at what each of these collaborative partnerships looks like in the real world when you formalize collaboration across the board.

1. Collaboration within sales

The collaboration that happens within the sales team—a.k.a team selling—can help you improve the efficiency of the sales process and speed up your sales cycle when you lean on your peers’ expertise.

For instance, let’s say you are a sales rep negotiating a deal with a prospect from a Fortune 500 company. You can increase the likelihood of closing the deal with this particular account if you can glean into the process that one of the top reps from your company employed to close a deal with a similar company just a few weeks back.

Maybe the account that you are handling has a complex set of integration requirements or maybe they have specific objections about your product pricing. Looking into how the other rep successfully navigated through similar deals in the past, how they handled objections, and how they positioned your product over the rival brands can teach you a lot about what questions to expect and how to avoid common mistakes.

Then there’s a coaching element to this collaborative partnership where you can reach out to leaders to help you push the deal forward in situations where you don’t know how to proceed. Experienced sales managers often have more context about the entire sales operations that might be beyond your visibility.

Therefore, they can lend you precious nuggets of information that can help you gain important insights about a deal, account, or the kind of prospects you are talking to.

And this collaboration is not just limited to meeting conversations. For example, fellow salespeople or your managers can look at how you are responding to prospect emails and improve the quality of your email response rate by just changing a few words or phrases in the email copy.

Usually, the more thoughtful your interactions with the prospects is, the more likely they are to accept your offer to schedule a demo, sign up for a trial, or bring in the right person in the negotiation process.

There’s an app called Front that makes email collaboration look like a breeze. Front empowers email collaboration by allowing you to tag or invite other people from your sales team to help you word your response better right within the email client. So the feedback is near real-time and highly contextual—as opposed to the old way of taking a screenshot from your Gmail or Outlook inbox, sharing it with your team via Slack, and copy-pasting their feedback back in the email client.

2. Collaborating with marketing

It’s a universally accepted fact that tighter alignment between marketing and sales leads to better outcomes. Without marketing’s support, sales is like flying a twin-engine aircraft on a single-engine capacity. It’s risky and hard to scale, to say the least.

The collaboration between the two teams helps sales leverage new channels like social selling and influencer marketing to draw the attention of the right audience and educate them instead of trying to push your products into their lives.

However, it’s usually the sales team who talk to prospects on a daily basis and it’s not a core part of their job to capture prospects’ feedback at length to share it with the marketers. As a result, a wealth of information in the form of customer feedback and important insights gets lost in thin air.

But if there were a process that automated or made sharing of such information effortless—salespeople would be happy to cooperate better because now it only takes them a minute instead of 15 minutes to compile their notes and share them with the marketing.

This has happened to us at Avoma more times than we care to admit. One out of four prospects who approach us ask our sales team the same question—how is Avoma better than Gong.io or Chorus.ai? We expect these questions, but instead of letting every sales rep answer such questions on their own, our sales shared this as feedback with the marketing team.

In no time, the marketing team whipped up amazing alternative pages comparing Avoma with Gong and Chorus that the sales team can now share with skeptic prospects in just one click. The collaboration has also led us to unexpected benefits like helping us drive SEO traffic to our alternative pages and improve conversions.

Our secret to such effortless collaboration between marketing and sales? Our sales team relies heavily on our own conversation intelligence platform to proactively share important information across the board that doesn’t require the sales reps to document their understandings of customers in a two-page essay format.

3. Collaborating with product and engineering

When the product team isn’t in sync with what’s happening on the sales front, it creates problems for all parties. While sales is busy increasing your company’s sales volume and accurately representing your product’s capabilities to the prospects, the product and engineering teams often tend to build the product in silos—mostly working on assumptions based on their conversations with a handful of potential users.

The further your product team is from the customer, the slower your product development is going to be and the farther away they are going to build products that your customers don’t want to use. On the other hand, closer proximity between the sales and product can help both teams improve the product quality and communicate the product value better.

We see this all the time at Avoma. We have built a culture for our sales team to share every single customer feedback, new feature requirements, new enhancements, or general friction points that our prospects don’t like on Slack channels or as Avoma as snippets.

As a result, many times our engineers build enhancements or tweak certain things on the product that were not originally part of a product roadmap. It has helped our sales in closing a deal more efficiently because they could convince fence-sitting customers about Avoma’s value by building small components into the product faster.

The free-flowing of customer feedback in common Slack channels also helps our product teams deliver delightful product experiences and act on pressing customer feedback immediately before it’s too late.

Traditionally, the sales used to feed such information to the product team through email who in turn created a JIRA ticket or documented it as a possibility in their upcoming product roadmap. This caused unnecessary delays or—worse—inaction because there was no direct feedback loop between the two teams.

But if the engineers listen to the feedback of customers going through some painful process—they usually take immediate action to solve the problem. It’s much easier for the sales reps to share customer feedback directly with the engineering because they can bypass a lot of process-related complications and solve the problem faster than how the product team would have liked to prioritize in the next product iteration.

4. Collaborating with customer success

In the past, the sales team just had one large target—to acquire new customers in order to meet or exceed your company’s revenue goals. In the subscription economy, such a plan would fall flat on its face if you don’t account for recurring revenue in your sales strategy.

No matter what your goals are—revenue, expansion, or maximizing customer lifetime value (LTV)—a better relationship between sales and customer success is an absolute must to achieve it.

If you think about it, customer success is a deeper-level extension of sales. While the sales team is responsible for acquiring new customers, the success team ensures that customers buy your product repeatedly so that you can maximize the lifetime value. Therefore, a lot of principles that apply to SDRs and AEs also apply to CSMs.

The role dynamics between sales and customer success is like the coordination that plays out between two teams of an airline. Sales is like the ground staff at the airport who usher passengers inside the plane. Customer success is like the aircrew who welcomes them on board, helps them settle in, upsells them on food and other services, and ultimately helps them make the most out of the in-flight experience.

The job of customer success begins where sales end—and customers expect nothing short of a royal treatment once they are on board with your brand.

It’s also why sales and customer success should have a smooth customer hand-off between them. If your customer success team doesn’t give them a matching experience they perceived during the sales stage—customers will soon opt-out of your brand. On the other hand, good collaboration between the two teams can help customer success identify the early signals of customer churn and stop the bleeding.

Collaboration between sales and customer success can happen through several means like setting common goals, sharing customer insights, documenting the best practices, and using the same collaborative tools.

5. Collaborating with AI tools and other technologies

Collaboration with AI and other tools has three-fold nuances to it.

Collaboration with AI and tools isn’t possible without people if they don’t have the right mindset for collaboration to start with. Therefore, people and their mindset are the first prerequisites.

Let’s take an example of new recruits joining your company. More often than not, new hires are shy to ask questions because they assume that they have already passed the window of time to raise questions during their recently-held onboarding program. But new hires should be reminded that everyone has different levels of learning curve. No question is inherently stupid since asking the right question might also help other hires who share similar concerns.

To overcome this challenge at Avoma, we have created a couple of dedicated Slack channels to help everyone get answers to their questions without any judgment. For instance, we have a channel called #product_questions that is open to everyone. Anyone who has a specific question related to Avoma can pop a question in the channel and get an answer in an instant.

Over time, the channel has served its purpose so effectively that now when a new recruit posts a question in the channel, it’s not just an expert from the product team who responds. Many times, it’s people from go-to-market teams who have acquired enough knowledge about the product’s technicality and are qualified to respond with the right answer.

The point is that people with the right collaborative mindset are one of the first prerequisites to enable collaboration with tools.

Next, you need to have processes to facilitate good collaboration between individuals and teams. Taking a leaf out of the same example from above, we at Avoma have clearly defined that anyone with a product-specific question should post it on #product_questions.

If anyone has questions related to customer support, we have an entirely different channel called #support to discuss those issues. To foster meaningful collaboration between people and teams, you need to clearly define ways and processes that they can follow to exchange or look for information.

Tools come in last only after people and processes are aligned in harmony. What tools people are adopting is less important than who and how they are going to use them. You can have an amazing collaboration with others on paper if you have the right attitude and processes around it. By the same token, you can have the most expensive tool for collaboration but it can fail with the wrong mindset and lack of processes around it.

Take the system of collaboration for instance. Most of the evolution in software technology can be traced back to some sort of system of records, like a CRM or an employee record management software. These were first-generation software that captured all important data and stored them in a centralized database. It’s why the likes of Pega, Siebel, and Salesforce proved to be really valuable during the 1990s.

The next-generation tools that became valuable after that were the system of engagement. Systems of engagement—such as email automation platforms, mobile apps, content management systems, live chat tools, or even social media—went beyond recording data and enabled you to engage with customers a lot faster. Some of the companies that continue to master the system of engagement domain include tools like Outreach.io and Salesloft.

Next up, it was the system of intelligence that dominated the collaboration space with software that gave you insights into your interactions with customers. But while the system of intelligence added a layer of insights on top of them, the intelligence was still not actionable.

It’s easy to take action—and collaborate—when you are talking to people, having meaningful conversations, or making important business decisions. The best collaboration happens over business meetings, email threads, Slack channels, or text messages. And that’s how the system of collaboration was born.

Early systems of record or engagement like Salesforce or HubSpot intentionally stifle collaboration—they charge people to collaborate with each other. But restricting access to information goes against the very definition of collaboration. Most—if not all—SaaS products should be collaborative by design.

That’s because the faster the collaboration happens in an organization, the higher its chances of succeeding. If you democratize customer information to everyone across your organization instead of limiting its access to a handful of salespeople, that’s when ideal collaboration takes place.

That’s the principle Avoma was built with. When we conceptualized Avoma, we wanted to make sure that the product teams can be as close to customer conversations as possible. We wanted to foster collaboration rather than creating friction and allowing access only to people who are on the frontline.

The bottom line is—once you have the right mindset and culture around collaboration, pick up the right set of tools that empower collaboration. With the right collaborative tools, you can move with efficiency, speed up your execution time, and drive better outcomes as a company.

Does collaborative selling scale?

Just because you are a big team—or you are growing big—doesn’t mean you can’t leverage collaborative selling. Sure, a few things will change here and there when you grow. For instance, you might add a few new rules and guidelines for efficiency or optimize a few processes to match your growth. But if you have built the right culture around collaboration during your formative years, scaling collaborative selling becomes really easy.

Fundamentally speaking, small teams are more efficient when it comes to collaborating. At Avoma, we are super-efficient when it comes to collaboration between cross-functional teams and reducing wastage. This efficiency has helped us create different product experiences and powerful functionalities despite being a small company of less than 25 people in a niche filled with sharks valued at billions of dollars.

Admittedly, things change when you grow big. Big enterprises lose their character as fast-moving startup teams when they start adding new processes and procedures around everything. They lose that agility to surprise their customers and become complacent with their growth. They might start sugarcoating their inefficiencies behind corporate lingo like “sorry for the inconvenience we may have caused you”.

The worrying part is—the more friction that you add to your collaborative processes, the more you slow down your company’s speed of innovation. It often results in customers being disappointed in the way your company interacts with them. Customer delight happens when you go out of your way to do something that they didn’t expect.

If you want collaboration to scale along with your growth, you want to avoid such sloppy culture. Ideally, you would want to retain that element of surprise of sweeping your customers off their feet. And it starts when you embrace your mistakes. You should be willing to admit that you screwed up when it happens and fix the customer problems right away. That’s how small companies operate and that’s what you would want to carry over even when you grow into a mammoth company.

Building sales compensation models

Paying your employees well is critical for your company for many reasons, such as attracting the right talent, retaining them, and motivating them to perform better.

In the SaaS world, good salaries matter more than you can imagine—especially when compensating your sales force. Hiring salespeople in the SaaS industry is an extremely competitive landscape. Just take a look at a few of these stats from Xactly, for instance.

- Technology and software companies experienced the highest sales attrition rate at 67%.

- In 2020, 58% of companies experienced higher voluntary sales turnover.

- The average tenure for a sales rep is about 1.8 years—even in the biggest ten tech companies.

- On average, it costs around 150–200% of a rep’s salary and nearly six months to replace a single sales rep.

Several SaaS companies try to bypass this problem by leaning on a product-led growth strategy—assuming the self-service checkout style of sales will cut off their go-to-market dependency from sales (and marketing). But relying 100% on product-led growth is a mistake that hurts a SaaS company’s growth, especially if it is growing rapidly.

This problem compounds further if you are a cash-strapped scale-up who is paying less than the market average. Potential candidates have a way of finding out how well or poorly your company pays through websites like Glassdoor or PayScale.

So what are you to do? On one hand, you need a ton of cash to bankroll your sales hiring. On the other hand, the sales reps may leave anyway, given the fierce competition to attract sales talent in SaaS.

Attracting good salespeople to your company and keeping them long-term is not very different from acquiring the right customers and keeping them loyal to your brands. Both customers and employees “choose” to spend their time with your brand. And compensating them well plays a big role in hiring amazing sales reps and grooming them to grow as sales leaders in your company.

Paying your sales employees is a bit more nuanced than paying employees from other teams in your company. If you understand these intricacies, you will be in a much better place to compensate your sales reps in a way that will motivate them and inspire loyalty.

Sales compensation components and models

Deciding on a sales compensation plan requires you to map your business goals to the sales position you are hiring for. It is much easier for you to figure out a well-structured compensation plan if you can categorize the different roles in your sales team into simple “bands” or levels of employee experience.

For instance, here’s how most HR teams bucket new employees in their hiring funnel:

- Entry-level

- Mid-level

- Experienced

The pay range for sales reps varies based on the band that they belong to because it represents the level of experience they come with. Segmenting your sales hiring into sub-categories often implies that the more specialized a sales rep is, the better your chances of hitting your company’s revenue target.

Once you sort out the different sales levels you need in your company, decide on the following compensation models to pay your sales reps regardless of their experience levels.

Base pay

Base pay is the fixed monthly/yearly salary that a sales rep gets in return for their service to the company. It is the only sales compensation plan similar to the salaries that people in other teams get. Base salary is often also known as the cost to the company or CTC. It’s called ‘base pay’ because, in sales, it’s rarely the only compensation that sales reps get. Sales employees often have a mix of basic salary along with variable pay, commissions, bonuses, etc.

Commission rate

A commission, or variable pay, is often calculated in percentage to a deal amount. For instance—if the base commission rate is 10%, they will receive $500 for a deal size worth $5000 or $1500 for a deal size worth $15000. Many companies don’t offer a base pay to their sales reps. They employ them entirely on a commission basis—directly mapping their sales performance either to the sales target or the company’s revenue.

On Target Earnings (OTEs)

OTEs are earnings that a salesperson qualifies for when they meet 100% of the sales quota set for them. By norm, OTEs are split 50–50 between base pay and variable pay. OTEs are often specified as part of the job description for a sales job. For instance, if a job ad for a sales position says “$45000 OTE”, the salesperson will receive their base pay plus the $45000 OTE. Just like the sales quotas, OTEs are usually expressed in yearly figures.

Bonus

Sales bonuses are financial incentives given out to salespeople who exceed the sales quotas set out for them. Bonuses should not be confused with commissions. Like commissions, bonuses are either expressed in percentage or a fixed amount. But unlike commissions, bonuses are not necessarily structured in a sales compensation plan. They are additional perks that a company may offer to its sales employees when they hit a revenue milestone—either individually or as a team.

Non-cash rewards

Not all sales compensation models have to be in the form of cash. Many SaaS businesses offer non-cash awards to their top-performing sales employees to keep their morale high. Take the President’s Club award, for instance. It’s one of the most celebrated awards within the sales circles reserved for highly driven salespeople who help their employer company crush an important revenue target.

In addition to achieving the coveted recognition, salespeople who win the President’s Club award often fly out to the desired location in an all-expenses-paid vacation.

Arriving at the right sales compensation model for your team

If you are expanding your sales team, getting your sales compensation right for everyone on the team can be tricky. If your compensation structure is flawed—even if unintentionally—it can lead you to several problems such as bad branding among potential sales hires, high employee turnover rate, or failure to achieve your revenue goals.

Thankfully, there are several options for you to structure sales compensation plans that can improve your sales hiring process and allocate the right resources to grow your revenue.

1. Map your sales compensation plan to business objectives

It’s a good practice to align your sales compensation plan with the business goals. But it’s easier said than done. To arrive at a reasonable calculation, you will first have to figure out answers to a few important questions:

- What’s your company’s current standing in the market?

- What’s your next revenue target?

- How many salespeople will you need to achieve the target?

- What are some of your weak points in sales?

- How do you reward your salespeople at present?

Once you have answers to these complex questions, it’s easier to benchmark your salespeople against reliable revenue data depending on your company’s location, industry, and size.

Here’s an example from the 2018 salary split data for Account Executives across the US shared by Peak SalesRecruiting:

Of course, you should also study the competitive landscape to understand how salespeople are being compensated in other companies. Combine this market data with the above answers, and you will have good clarity on what’s a good base pay for each band, how to structure your variable pay, and if you should offer other perks like bonuses or non-cash incentives to keep your sales compensation fair and competitive to the market norms.

2. Based your sales compensation on what they bring to the table

Sales reps who are specialized in selling to enterprise accounts deserve a better paycheck than those who come with a track record in selling to mid-market accounts. That’s because a single enterprise account often brings more revenue to a SaaS business than multiple mid-market accounts combined.

That said, it’s only fair to structure your sales compensation plan in a way that compensates a rep based on what they have to offer. For instance, the base pay for an entry-level account executive is significantly different from the base pay for a seasoned inside sales manager. The commissions and other perks can also differ based on a salesperson’s seniority level, portfolio, skills, and other attributes.

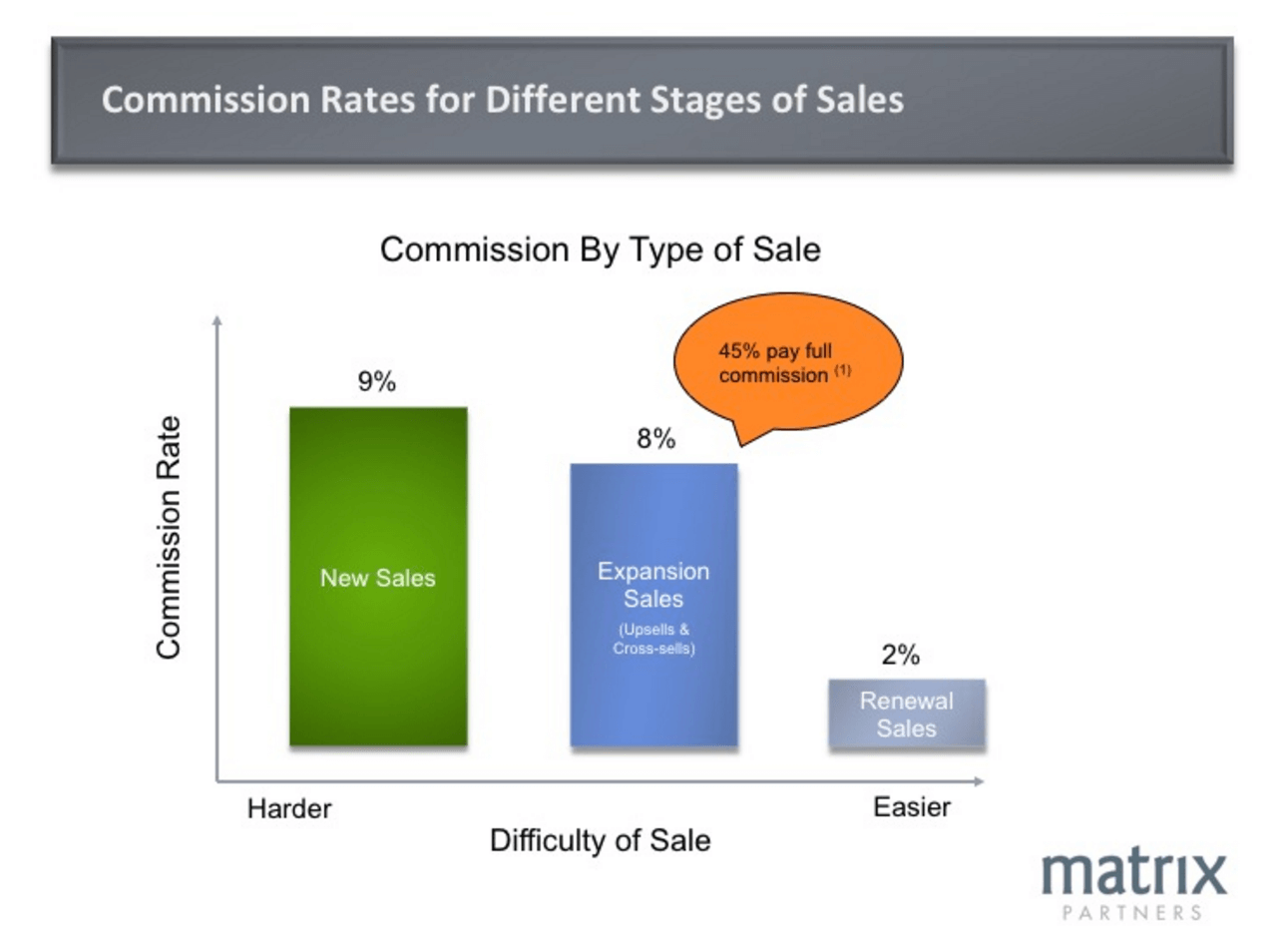

For example, you want to plan your commission rates based on the stages of the sales cycle.

3. Offer a good mix based on your unit economics

A good sales compensation plan accounts for a good mix of base pay and a generous performance-based variable pay. The base pay gives your salespeople a sense of financial security, while the incentive component keeps them motivated towards their goal.

For example, most sales-driven SaaS companies offer their sales reps a fixed base pay + (x)% of every deal closed. Many of them offer a 50–50 split to keep it fair and square. Others make the variable pay higher in ratio to the base pay to incentivize good performance.

Your unit economics (cost-to-revenue ratio) is at the fundamental of your compensation model. As a very rough guide based on our experience, it makes sense to set a quota that’s approximately 5x the OTE, including base salary + bonus.

But, this is just a guideline. The complexity and difficulty of your sale will determine the ratio your business can support. The idea is to arrive at a win-win arrangement to ensure that the sales reps get the compensation they deserve while the company maintains a healthy profit margin.

4. Don’t be afraid to apply clawbacks

Research from a few years back shows that underperforming sales hires can cost a company anywhere upwards of $2 million. Companies usually invest hundreds of dollars into hiring, training, and compensating their sales employees. When they don’t perform, quit, or are fired from their positions, the company sets back by hundreds of thousands of dollars—or more. Selling to the wrong customer account is also a huge part of the problem. Sometimes sales reps may sell to any and every account to stay afloat or crush their quotes.

Clawbacks are enforced largely to discourage sales reps from selling to the wrong customers. The idea is to acknowledge sales as a stakeholder in retaining customers—and not just in acquiring new ones.

Clawbacks are measures to retrieve commissions from a salesperson if a customer churns early or doesn’t hit a benchmark. For instance, let’s say a salesperson receives a commission of $700 on closing a deal worth $7000/year. But if the customer churns before completing three months with your company, the salesperson has to repay the $700 commission to the company.

The idea is to encourage better sales discovery and thereby product-customer fit. Ideally, clawbacks are usually balanced with a clause that makes customer retention the responsibility of the customer success team after three months. That way, sales reps get appraised for each deal they close while keeping their commissions.

Final thoughts

We hope that the above guidelines will help you identify the best model for compensating your sales teams. Compensating sales teams in SaaS companies is always a bit tricky because the core business objectives don’t stop at selling to new customers but keeping the recurring revenue model strong for longer. Therefore, you would need a sales compensation plan that incentivizes the salespeople to sell to the right customer accounts, be a part of the retention strategy, and perform at their top levels at all times.

Ultimately, compensating your sales team well doesn’t just solve the problem of attracting, grooming, and retaining the best sales talents but also helps you push the envelope when it comes to scaling your revenue potential.

Mapping how businesses buy software

We all want to be data-driven, optimize customer journeys, engage them well at each touchpoint so that we can seamlessly advance them from one sales stage to the next, and thereby leading to retention, renewals, and referrals. But it all starts with understanding how businesses buy (especially in a B2B SaaS set-up), what they care about, what qualifies as a great buying experience for them, and then building a process around that understanding.

In this blog post, we will talk about understanding what an average SaaS buyer goes through as part of their buying process, how to adapt according to the buyer maturity stage, how to tackle competitive deal situations, and the key pillars of buyer experience.

The impact of touchpoints in the SaaS buyer journey

A SaaS customer journey is very similar to the path taken by customer journeys in other markets with some nuances.

For example, a SaaS customer may begin their journey with your brand by reading a review by one of your customers on a software review site. And with every other touch point, the customer comes closer to your brand by adopting your freemium subscription/pricing, enjoying the user experience your product offers, interacting with sales and customer support, and so on.

All said, how you sell is how you win.

From the website visit to customer onboarding and beyond—it could be the simplicity of the form on your demo or sign up page, how quickly the sales reps follow up, or sometimes it may be the tool that routes the meeting requests via the calendar—every single touchpoint matters!

A study done by Challenger in 2019 revealed that buyers attribute 53% of their buying decision to their sales experience.

And that means as a sales organization, though you have a very short window of time with your buyers, your influence is outsized.

The difference between a good buying experience and a poor one is that the SaaS organization that offers a bad experience hasn’t thought through every detail. It’s easy to think about the experience in parts such as following up with the prospects after they convert, or having them talk to our SDRs.But if you aren’t thinking about the buyer experience holistically, you’re already doing an enormous amount of harm there to that buying experience.

The moment a prospect engages with your brand through one of the touch points (e.g.your website), the clock is ticking and every single touch point from there on matters!

Factors of influence in the buying process

Based on our observations as well as conversations with a bunch of our customers, we see that there are at least 4 major factors that influence the buying process.

1. Circle of trust

Given the number of online communities, groups and social media connections we have today, one of the first steps that buyers take before getting into the buying process is—reaching out to their circle of trust.

For instance, a buyer interested in investing in a conversation intelligence solution usually reaches out to their trusted communities like Reddit, G2, or Facebook groups in SaaS to research the tool, ask others about their first-hand experience, get an overall feel of the product, and possibly even a demo of the product in action.

2. Their own past experiences

Another key factor of influence is one’s own past experience with a brand or a product. For example, if a buyer has already used Hubspot CRM in the past, and has had a great experience—chances are they will go back to the Hubspot team again. If you’re in Hubspot’s shoes, this is also one of those moments where you have an opportunity to craft a unique buyer experience rather than having them go through the whole sales cycle from scratch.

3. Fresh demand created by a marketing or great sales outreach

There’s a lot of power to demand generation and sales outreach. Inbound and outbound go hand in hand. A prospect might come across your posts on social media, or might consume your content via blogs, podcasts, or ebooks—or maybe something that one of your outbound specialists said resonated with them—and they want to learn more about your product and evaluate it for their use case.

4. Free-trials and your online reputation

Consumers want to experience the product first hand and one of the first things they often seek is the possibility of test-driving your product. Specifically in SaaS, there is no debating that free trial is a big ice-breaker. The try-before-you-buy experience has a magnetic pull for attracting new leads, driving sign-ups, and quickly converting high-intent users into customers.

Subsequently, the allied aspects of influence are: transparency of your pricing (a pricing page that doesn’t merely ask them to talk to sales), reviews on business review sites such as G2, and more. From our understanding of talking to customers, most customers shortlist anywhere between 3-5 solutions to choose from.

Now that we’ve the various factors of influence, let’s look at another factor in the buyer experience—the mismatch in understanding of the buyer stage.

The buying stage mismatch

One of the key aspects to understand during the sales process is—the stage that a buyer is in. Many times it’s possible that the stage that a salesperson moves a buyer into might be very different from the stage the buyer is actually in.

Imagine a scenario where you shared your understanding of the buyer stage transparently with them. Chances are they might disagree with you on both sides of the spectrum. Either they might be far ahead in their evaluation and buying process or they might be too early in their journey.

So, you want to make sure that you’re aligned with your buyers and take them through the right journey. You cannot have a one size fits all approach.

Mapping your sales process based on buyers

Today’s customers know a lot more about the software categories, the key players in your category, the different approaches each player takes to solve the problem, and more.

This wasn’t the case 10 years ago and you had to talk to the salesperson to get more information about the products. You couldn’t go to communities like Pavilion or Bravado and ask your peers, “What’s your experience with company XYZ’s platform?” like we do today.

Hence, salespeople were the gatekeepers back then. But in the current times, we cannot look at sales as gatekeepers anymore.

1. Understand the buyer stage

Today’s buyers come to the table educated. Before they reach out to you, chances are that they’ve already spoken to your customers and have an understanding of what it feels like to work with you, and how effective your product is in solving their problem.

While talking to Carl Ferreira, the Director of Sales at Refine Labs, he said:

I gave demos of Chilli Piper to two of my customers at Refine Labs. They hadn’t even spoken to Chilli Piper’s sales yet. Imagine this—they hadn’t even come into the sales radar of Chilli Piper and I had already compared their product to some of their competitors. That’s today’s reality which you see in private Slack communities all the time.

Sales is now a facilitator, not a gatekeeper anymore. However their impact in their limited time with the prospect is high.

Therefore, the sales process needs to be adapted based on the maturity stage of each buyer. Your buyers can always sense whether they are treated as if they’re in a much earlier or later stage compared to their current stage.

For instance, if a buyer has already done their research, clearly knows what they want, and all they want is to see the solution in action and get their questions answered—the last thing you want to do is to drag them back to the initial qualification stages just because you have a process.

Your sales process needs to facilitate the buyer and should not be geared towards the seller.

2. Have different processes for your key buyer types

When you design a buying experience, you need to think outside the box. Not every customer journey is linear where they have to go from an Sales Development Representative (SDR) to an Account Executive (AE) for a discovery conversation and then a demo.

We cannot have one approach that fits every buyer. The linear approach needs to be torn down and we need to think from the lens of the customer as to what’s in their best interest.

Sometimes, depending on the prospect, it’s best they don’t talk to an SDR. Not even to an AE. Maybe it’s best that they don’t talk to anyone. Just let them sign up for your product and experience it for themselves.

But make sure that there’s someone always available to assist when the prospect needs help.

Let’s take another example. Let’s say a VP of Sales (a key decision maker in your target account) comes inbound into the sales cycle. You don’t want them to go through every step in the sales cycle. In this case, you want to make sure that this person skips the line and is directly talking to a subject matter expert.

The idea is to let them talk to their counterpart in your organization so that the resonance is high.

You might want to have criterias which can be the basis to route the prospects to ensure appropriate buyer experience.

3. Don’t let little annoyances build and compound

There is no one single touch point that makes you lose a deal. With every mismatch of expectation versus reality, the little annoyances keep building up and it compounds. For example, let’s say you have “Free trial” as a call to action (CTA) on your website and it leads you to a form to book a demo with a sales rep—that’s a mismatch. That’s not a free trial.

Even if you offer a true free-trial, there is an experience layer on top of it.

If you offer your prospects a free trial of your product, you might want to add a human touch to it for better impact. By design, most product trials are set up in a way where sales is entirely cut-off from the automated process.

While your company may have originally done this to give customers a self-paced product experience and allow the sales team to shed some of their load on automation—it’s not a black-and-white territory. Prospects opt-out of your funnel for various reasons and it’s helpful if the sales reps know when to step in to prevent the drop-offs.

Instead of leaving your prospects at the mercy of their self-discovery, give them the option to reach out for assistance when they want to. Include a CTA in the email nurturing or your product interface.

This is a win-win strategy: your customers can opt for a personalized buying experience at their beck and call while your AEs can gain deeper visibility into the process and remove any possible friction from the buyer’s journey.

Summing up…

If you had to sum up the entire buyer experience and distill it into a framework—it boils down to three things: mindset, measurement, and execution.

Mindset: It’s about thinking differently about your buyer. Your buyer probably knows about your product already, they might know the cost, they might have already seen a demo. And that means you need to change your mindset and approach based on how much they’re already educated about you.

Measurement: You need to look into your process and understand where things slip through the cracks. It’s about understanding the math of your pipeline, the time between deal stages, the engagement at each stage. Regular pipeline reviews really help in bridging the gap.

Execution: Finally execution is all about taking the learnings from each stage and meticulously crafting the sales process in a way that makes sense to your buyer. Crafting the right process might be anything from hiring the right team, mapping each stage of the journey, to investing in the right tools.

Running pipeline reviews

Anybody who has been in sales, at least for a decade, must have conducted pipeline reviews, as well as been part of pipeline reviews where the manager shows up and says “What are you committing this week?” “What’s your best case?” “What’s your worst case?”

And they take those numbers, and go on to reporting up to their functional leaders.

But, is it what pipeline review is all about? Not really.

Anyone who operates with that kind of tunnel vision, is missing a lot. They’re missing out on what those metrics tell them.

Sometimes as sales leaders, we’re all moving so quickly that we just want to grab those metrics because they’re part of the reporting process on a weekly or monthly basis. But there’s more— there’s a story behind those metrics, a set of things we can learn by running pipeline reviews, how we can use these reviews to help the Account Executives (AEs) and reps by removing friction along their path.

Through this blog post, we’ll try to understand what a pipeline review is, the structure of a pipeline review, what to cover during the review, and a lot more.

What is a sales pipeline review?

For starters, a sales pipeline is a visual representation of your sales process where one can see the different deals being at different stages (Qualified, Negotiation, etc.) of the sales cycle. In other words, it’s an overview of all the deals your reps are actively working on.

Therefore, a sales pipeline review is a meeting where AEs and reps report to their leaders about the deals they have in their pipeline, deals that are likely to close, and more importantly use the opportunity to seek help in advancing the deals that are getting stuck.

The misconception about sales pipeline reviews

A sales pipeline review is essential for every business to know where they stand, but it’s not all about metrics and reporting up. Historically, pipeline reviews have been about metrics, and when we do that, we’re focusing on only one side of the coin, whereas the real purpose is supporting the reps from the downstream perspective.

And that means we need to go a level deeper than just asking “What are the deals in your pipeline?” or “What’s your best case and worst case?”

Instead when my rep says “I’m committing a deal” we should be asking:

- Why are we committing this deal?

- Why are you committing this deal and what day are you committing it on?

- Why is it that day?

- What’s gonna be the price of that deal?

- Why is that the price?

- Who are the people involved in the deal from the prospect’s side as well as our side?

- What are the indicators that your customer has given?

I think as sales leaders, sometimes we are moving so quickly, we just want to grab those metrics because they’re part of the reporting process on a weekly or monthly basis. We just want to get them done.

The true value of a pipeline review is in understanding the story behind every deal in the pipeline and what is needed to advance those deals to closure. In fact, it is particularly helpful for the reps in the early days of their career to get a holistic perspective.

Therefore, if you’re not making the best use of pipeline reviews:

- You’ll not have an overview of your team’s sales pipeline and its health

- You won’t have enough external and internal context

- You won’t see the potential threats in each deal

- Your sales forecasts may not be accurate

So, while it’s important to hit the numbers—it becomes equally important to leverage pipeline reviews to understand the friction points and try to unblock them as much as possible.

Structuring a pipeline review

When it comes to running pipeline reviews efficiently, one of the first things that come to mind is—how frequently should you run it? What should you cover during the review meeting? How long should these meetings be?

For starters, there’s no stringent rule on how long or how frequently you should run pipeline reviews. If you’re an early-stage startup, or say a series A organization—it makes more sense to run pipeline reviews at least once a week to ensure alignment amidst all that’s happening in your fast-paced growing organization.

Here are a few things options you may want to consider:

Frequency

- Weekly or atleast bi-weekly (in early stages)

- Monthly (depending on sales process maturity)

Size

- Better to do 1:1s in early stages to help individuals

- Meet as a team to review bi-weekly

Meeting duration

- 30 minutes for 1:1s

- 60 minutes when you meet as a team

Meeting structure

- Review the health of all deals in the pipeline

- Take stock of deals in the Create, Advance, and Close stages (discussed in detail below)

- Discuss what’s need to accelerate the high-priority deals

Key takeaways

- Each review should conclude with clear action items for each AE and rep regarding their respective deals. These can be anything from how to tackle an obstacle, negotiate, or kill a deal.

All said, the above structure is not sacrosanct. It’s just a starting point and you can iterate and improve on it as you go.

Tips to make your sales pipeline reviews efficient

1. Encourage inputs over outcome

Typically, here’s the story that a rep brings to the pipeline review:

- What’s happened with the accounts in my pipeline this week?

- Where do they stand in terms of deal stage?

- What are the next steps?

- Inputs on what needs to happen to close the deal

- Expected timeline for closure, etc.

While all that’s important, remember that nobody has complete control over closing a deal. There may be some deals that sales reps run really well, but at the end of the day that does not always happen.

You can’t say with 100% certainty that anybody is controlling the narrative, the conversation, the process from beginning to end, right?

There re so many variables that take place, and although “hope” is not a strategy, as long as you line up everything correctly in your deal cycle, you get to the end of it, and there’s a little bit of hope saying, “I did everything I can, I hope that they go with me”

Most of us recognize our teams only on deal closures and commission retired. As sales leaders, especially during a pipeline review, we tend to focus too much on metrics.

At the end of the day, we want to encourage every rep to focus on the controllables, i.e., the way they run their sales meetings to ensure the best possible customer experience.

For instance, sometimes you might do everything right, but the prospect might not be ready to take the leap. Because that’s not in your control.

To sum up, what matters is how we execute. The buyer experience is everything. In fact, we at Avoma reward our teams based on inputs over outcomes.

2. Practice the Create – Advance – Close Model

Over the years, one of the things I’ve consistently seen as part of pipeline reviews is the heavy focus on what deals are closing and what do we need to do to close those deals.

The issue with that is—you focus only on the deals that are moving towards closure, and suddenly your pipeline looks empty because the deals you had in the relatively earlier stages don’t get the attention it deserves.

The point is—you don’t build your pipeline, empty your pipeline, and then start all over again. You don’t want to create those rollercoaster quota metrics.

You rather want to maintain a steady pipeline and close rate, quarter-over-quarter, and month-over-month.

So we developed a model that we call “Create. Advance. Close” where we always focused on deals across different buckets:

- Create: What’s coming in top-of-the-funnel

- Advance: Deals that are early in the funnel as well as late in the funnel that need to be advanced to the next stage

- Close: Deals that need to closed, i.e., what’s needed to get the customer signature on the dotted line

It’s the responsibility of every sales leader to make sure that we spend enough time on all the deals across the above three categories.

It’s important because it helps you identify where you need to improve. For instance, you may have a rep that is not focusing on the ‘create’ motion, or maybe you have reps who aren’t the best at advancing deals.

For example, not every deal advances naturally. Sometimes deals stall at different stages. In such cases, the solution that I often suggest to my reps is “let’s make sure we have the next meeting scheduled.” In other words, any deal that doesn’t have the next scheduled event, is considered a “stalled deal” or “deal that isn’t advancing.”

As part of the pipeline review, it is the leader’s responsibility to help reps by helping navigate their deals to the next stages. And this is precisely why pipeline reviews shouldn’t be all about metrics.

Momentum is the key with deals, and time kills all deals. You want to ensure that deals are progressing as quickly as possible.

So, focusing on each of these three categories helps you identify gaps and train your reps on how to be proficient and effective. The idea is to make sure they’re giving enough attention to deals at each of those stages, thus ensuring you always have a healthy pipeline at any given point.

In fact, I would suggest that you have a checkbox on your CRM for deals that are progressing or stalling. You can run reports of deals by those stages and coach them as needed.

3. Control the overall narrative across sales pipeline stages

We all have heard that people buy from those they trust, but what’s important is that they want someone who can hold their hand and walk them through the sales cycle. Prospects are in the buying process for different reasons or in different stages, for example:

- They are buying a product in your niche for the first time

- They aren’t happy with that what they bought previously

- They haven’t been involved in software purchases for years

And for all you know, buying software isn’t a fun experience for many people.

Does this sound familiar to you as a buyer?

You’ve done all the research, and now you’ve shortlisted 3-4 products with which you want to schedule demos and make your decision based on the one that’s the best fit for you.

Although you end up talking to a BDR who asks you a set of questions and then schedules a demo with the AE. Now that you’ve answered the questions, you hope to see the product in action.

But no—the AE now gets on the call with you and asks you the same questions. It takes a long time before you get to see the product, pricing, etc.

Sounds familiar, right?

Controlling the narrative is about switching this whole experience on its head. And what that means is the BDR telling you something like this:

“Hey, I understand that you’ve done your research, and thank you for choosing us. We’re confident that we can help you. First, let me walk you through how companies buy our product. Then, let me walk you through the process.”

The point is you set the right expectations at each stage. By doing that, you’ve given your buyers an overview of what’s to come and guided them through the process.

For example, sometimes, it might be that your prospect wants a quick demo, but at your end, you know that the demo would make more sense once you have enough context of what they’re trying to solve.

So you can tell them how a demo would be much more effective once you have some more context on X, Y, and Z factors. It helps them understand why you’re asking them those questions instead of coming across as BANT qualifying them.

Ultimately, for a prospect, it boils down to:

i. Do I trust whom I spoke to?

ii. Do I trust the company?

iii. How did they treat me during the buying process?

That is why it’s important to control that conversation and narrative. And this is something that every sales leader must invest in to ensure that every rep does it well.

How is this relevant to running pipeline reviews effectively?

Great question! A lot of the time, we tend to gloss over the strategy behind deals. When you’re trying to help your reps advance deals in their pipeline, you need to know the strategic narrative behind those deals, i.e., how are we controlling the conversation.

Controlling the narrative means ensuring that the value is communicated well at each stage to increase the odds of the deal moving to the next level. It’s less about asking permission at each stage but guiding and directing prospects on how they buy our software.

Finally, leverage deal intelligence to make the most of your pipeline reviews

Avoma’s Deal intelligence extends the power of conversation intelligence to enhance revenue operations. With Deal Intelligence, you get a 360° view of all deals in your sales pipeline, pipeline health, deals that are potentially at risk, and more. In fact, you can also deep dive into a specific deal to understand:

- Who are the people involved in the deal from your side as well as the prospect’s organization?

- Who are the key decision-makers engaged?

- What stage is the deal in currently? Is it progressing or stalling?

- The number of conversations across meetings, calls, emails

- The last contacted/engaged date and more

If you have context of all the above factors, and are clear about the next steps—your pipeline review was effective! If not, we hope this blog post gives you a solid base to start.

Sales enablement to revenue enablement

We’re in a time where it is almost trite and cliche to say that most of the sales touch points and interactions today are remote. With every touch point across the buyer journey, we’re either pulling prospects towards us or away from us, based on the experience we offer.

Sales enablement is one such buyer experience layer as well as a critical component of revenue operations (RevOps) where there is a lot of scope for improvement for most companies. The experience we deliver in the form of sales enablement has a direct impact on revenue.

Therefore, as sales leaders, it’s important to realize that sales enablement needs to consciously evolve (if not already) into enabling revenue. In short, it means enabling prospects and customers across their lifecycle (before becoming a prospect to after becoming a customer), rather than merely focusing on helping your sales team to advance a prospect from one stage to next.

Wait—what’s really the difference again? How is revenue enablement different from sales enablement as we see today?

Is revenue enablement a new buzzword for sales enablement? Why is it important—and why now? What are key focus areas that will help us transform sales enablement into enabling revenue?

These are exactly the kind of questions we hope to address through this blog post.

How does sales enablement typically work?

In a typical SaaS environment, sales enablement is the process of regularly providing your sales team with the resources they can use to engage their prospects and advance deals in their pipeline. And that means sales enablement includes people working in as well those outside of sales.

So what does that mean? Who really owns sales enablement in SaaS?

As far as I’ve seen, it’s mostly owned by both marketing and sales. Marketing equips the sales teams with a variety of resources they need across the sales stages—where the resources include blogs, ebooks, case studies, videos, product guides, and more.

Though marketing is generally a one-to-many function, sales reps share these resources in a one-to-one manner with their prospects based on what’s the best fit for their stage to help them advance in their sales conversations.

The real collaboration between sales reps and marketing is when reps share feedback with the marketing team on the resources that are missing, so that they can enable their prospects better. Sometimes, it might happen that the content resource exists, but the sales reps aren’t aware or don’t know where to find it.

Therefore, you need someone in the sales enablement group to understand the sales process, the kind of questions sales reps or AEs may get during different stages of the buying cycle, equip the sellers’ repertoire and continuously update them about the newly-added resources.

If you think about it, overall approaching sales enablement this way is very reactive.

Why shift from sales enablement to revenue enablement?

Over the last few years, there’s been a big shift in the way customers discover solutions they need to solve their business problems.

Customers increasingly come in prepared for a sales discovery and demo conversation, which means the reliance on gathering information from sellers as a primary source of information has changed to digital channels.

Because of the change in how customers buy, the old school sales enablement of supporting the sales team alone with the required resources is not enough.

The Heads of sales enablement need to evolve their approach to support the various touch points across the cycle making it a revenue enabling process rather than just enabling the sales team.

According to SiriusDecisions, revenue enablement is defined as:

Revenue Enablement is the process by which you most efficiently acquire and maintain customers, maximizing revenue gained through each stage of a customer’s journey with your organization.

As customers increasingly research solutions on their own and make purchases through digital channels, it’s time for us to realign our go-to-market (GTM) approach. For instance, here’s an interesting list of observations from a SiriusDecisions study:

Similar to the above listed factors, we at Avoma realized that some of our customers like to try the product on their own, whereas some of them prefer a salesperson to answer their questions with a show-and-tell demo.

It helped us come up with two key GTM models:

- Completely product-led (PLG) GTM motion

It’s a process where customers directly sign up to trial our product and end up being a paid customer without ever talking to our sales team. So, in theory— at least—the product-led sales process diminishes the role of sales from the sales process. And this is why taking a PLG route is a tempting choice for many SaaS companies.

- Product-led and sales-assisted GTM motion

Going completely PLG is not practical in most situations where every customer is different. Sales-assisted is NOT the usual flow of prospect signing up for the demo of your product and going through the sales motion. It’s about offering a personalized customer experience from the get-go—and “assisting” the prospect in their self-discovery without being salesy. The whole point of offering a ‘sales assisted’ experience boils down to removing any friction from their buying journey.

The above story is to say that enabling revenue is more than just enabling sales and support teams with content, but enabling customers based on how they like to buy.

So what does the shift from sales enablement to revenue enablement really mean?

Sales enablement serves the sales team, whereas revenue enablement serves the prospects and customers by improving workflows across all customer-facing touchpoints which includes functions such as sales, customer success, support, as well as the product-led nurture.

Revenue enablement extends beyond your internal teams and product-led enablement too. For example, it involves training, offering tools and all the resources to all the collaborators in your ecosystem such as channel partners, resellers, and system integrators.

By doing that, you ensure:

- A consistent buyer experience across all your channels and no room for miscommunication in terms of messaging related to your solutions

- More visibility into the buyer journey so that you can continuously optimize your enablement efforts

- Alignment across your internal functions as well as collaborators in your ecosystem

How is revenue enablement any different from sales enablement?

- Wider catchment than sales enablement: Revenue enablement has a wider catchment area compared to sales enablement as it enables all types of revenue–sales, retention, referrals, renewals, upsells, and cross-selling. It looks at all the ways a customer can contribute to business revenue and aims to support each and every touchpoint.

- Customer-centric than sales-centric: Revenue enablement is focused on helping the customer, removing friction in their journey (the product-led & sales-assisted model discussed above is a great example). To be clear, with revenue enablement, it is not just about enabling the prospects, but also about customers and anyone who interacts with your organization in any way by offering them the best possible experience.

- Enabling revenue is full cycle: It engages the target audience long before they become prospects and continue to engage in the later stages of the customer lifecycle too. On the contrary, sales enablement starts only after a lead lands on the marketing or sales radar and is primarily focused on advancing prospects to the next stage of the sales cycle.

- The metrics are very different: While sales enablement measures metrics such as deals closed in a particular time period, time-to-close, etc.; revenue enablement measures customer metrics such as customer lifetime value, customer satisfaction numbers, and retention rates.

Overall, it’s about moving from being a system of information and engagement, to a system of collaboration on top of the existing layers. Here’s an example of how we at Avoma have gone about building a system of collaboration.

Key focus areas to optimize sales enablement for revenue operations

There are three key pillars to optimizing sales enablement for revenue operations, namely:

Talent development

As an extension to understanding the gaps in the buyer journey and technology investments, the next logical step is to identify the gaps in the customer experience delivered across teams involved in the revenue generation process. It makes a lot of sense to regularly train them and align the teams on a common set of metrics to measure the impact.

Content

While one of the key components of revenue enablement is creating sales enabling content and reviewing existing content, it is also important to make sure that the content is centrally available to all those involved in revenue generation.

In fact, at Avoma, we have an internal process where the entire revenue team and the content team catches up once a week to go over the content strategy, alignment, and the recently created content so that everyone is on the same page.

However, remember that revenue enablement is more than just enabling your internal and external teams. The core purpose is to enable your customers and prospects to have a seamless journey with your brand.

And that could sometimes even mean helping your teams extend the brand experience for those who have not yet engaged with your brand—for example helping your SDR team with a LinkedIn strategy.

Technology:

The first step is to map out the entire buyer journey to understand the touch points and sales enablement gaps. Once you do that, you can take stock of the sales, marketing, customer success, and customer support technology across the lifecycle. The goal at this stage is to eliminate the redundant and unused technology, invest on newer technology based on the gaps identified, and integrate sales, marketing, customer success, and support enabling a seamless customer lifecycle. Then expand it to your network of partners and other external enablers.

Implementing revenue enablement: Step-by-step

1. Planning

While sales enablement is a great starting point, the evolution to revenue enablement needs you to have a clear plan to enable revenue across all touchpoints. Before you get into the planning phase, you first need to outline the mission, vision, and goals to the revenue generation teams.

The planning phase includes asking yourself questions such as:

- What are the teams that need to be supported?

- Who are the key revenue enabling stakeholders across functions teams that we need to take inputs from, share outputs to?

- What are the key revenue enablement goals?

- How will the revenue enablement efforts be measured?

- What does a well enabled team look like?

2. Design the process

Once you have clarity on the goals and what to measure, the next step is to design a process for revenue enablement. The process design includes:

- Understanding the customer journey completely and mapping the touchpoints

- Designing the right inbound and outbound programs including the KPIs to measure within the organization as well as the extended enablement ecosystem such as partners and resellers.

- Designing the selling process so that it’s very clear as to—at what stage does the SDR team come in, when does the AE take over, when does the customer success handoff, and what each of these steps look like

- Mapping the right content for the right programs, identifying content gaps, etc.

- Establishing a cadence for content, events, training, onboarding and feedback loops

3. Create playbooks

The next step after establishing a process is to create and document the plays across your internal and external ecosystem. For example—your internal ecosystem includes sales leaders, sales managers, AEs, SDRs, customer success managers, and more. Here’s an example of the playbooks that we have established internally for sales and customer success.

Similarly, you can also create playbooks for your external ecosystem including partners, resellers, and more.

4. Implement the right tech stack

Now that you have clear plans, processes and plays in place, the next step is to build a tech stack that can drive scale, automation and efficiency. To build the right tech stack for your team, you can refer to the mapping of your customer lifecycle and identify the steps that can be simplified, automated, shortened, or streamlined.

Some questions that may help in this stage are:

- Which of the current processes can be removed or streamlined?

- How comprehensive are the tools in terms of their features?

- What integrations do they support?

- Is it better to go for an all-in-one platform that enables cross-functional collaboration vs best-in-breed solutions?

- What functionalities do you need out-of-the-box vs. what are your good-to-haves?

Typically, a revenue enablement stack tends to have:

- CRM

- Sales engagement tools like Outreach or Salesloft

- Conversation/revenue intelligence platform like Avoma or Gong

- Content management system

- System for product adoption analytics

- Project management tools like Asana or ClickUp

- Customer success management tools like Gainsight or Totango

5. Ensure alignment and measure outcomes

As you begin building your revenue enablement techstack, ensure that you have alignment on your product messaging across your internal and external enabler ecosystem.

From our experience, we can tell you that it makes a lot of sense to have regular catch ups on the story, the way customers are onboarded, what the brand experience should look like, etc. It really helps to establish a cadence to regularly update the stakeholders and collect feedback.

And finally build a process to regularly measure, manage, and optimize your programs based on their effectiveness. Setting up dashboards to capture the effectiveness of your program across the stages of the customer lifecycle helps you see where the ball gets dropped and improve those areas continuously.

Revenue enablement isn’t revenue at any cost

To sum up, for anyone who engages with prospects and customers at any stage, be it a discovery call or troubleshooting an issue—it’s all about enabling the customer and building positive experiences. Though the term “revenue enablement” may sound like it’s all about enabling revenue creation, it’s not revenue at any cost. It’s about strategic growth, which at its heart is—revenue as a result of delighting prospects, customers and anyone who interacts with your brand at every turn.

Optimizing RevOps for growth

Every business in this world exists to fulfill the major two goals:

- to serve its customers

- to drive revenue

Both of these goals are symbiotic in nature—you can’t achieve one without the other. And at some point in your growth, generating revenue becomes a matter of survival because you can’t sustain your business for too long if it isn’t driving enough revenue.

And if you are building a sustainable business—the goal is not just to generate revenue but to bring predictability and optimization into the process of generating revenue. In a nutshell, that’s what revenue operations is all about. And that’s exactly what we are going to talk about in this post.

In this post we will cover:

- What is revenue operations or RevOps?

- Why is it more than just sales and marketing alignment?

- How to leverage deal intelligence to improve RevOps

What is Revenue Operations (RevOps)?

RevOps is the umbrella term to define everything that you do in your business to generate revenue or to bring predictability and optimization into the process of generating revenue. For example, bringing cross-functional alignment and collaboration across your organization is an outcome under RevOps. Reshuffling a business function (e.g., customer success) to make it more accountable for revenue is also an exercise under RevOps.

RevOps is a strategic alignment of all your resources to bring clarity, transparency, and efficiency in your internal processes to achieve (or exceed) your revenue goals. It leverages people, processes, and technology, and optimizes them meaningfully to contribute to your company’s revenue growth.

However, the concept extends beyond the simplistic understanding of bringing alignment between marketing and sales. Essentially, here’s what RevOps looks like in a Venn diagram:

By aligning your resources and enhancing cross-functional collaboration, RevOps not only improves your bottom line but also creates a great customer experience that feeds back to your recurring revenue.

RevOps is more than just sales and marketing alignment

The most common myth around RevOps is that it’s a binding agent between sales and marketing. While it’s true, that understanding doesn’t encapsulate the entirety of RevOps. For instance, marketing and sales are not the only teams that contribute to an organization’s revenue. If your other functions such as customer success and customer support are not on the same page towards contributing to revenue—your RevOps is far from being perfect.

That’s because customer success and customer support help you fight customer churn and improve retention. You can’t build a predictable revenue pipeline—especially in SaaS—if your revenue generation activities are not in sync with your retention process.

Secondly, the alignment between cross-functional teams and their resources is a byproduct of RevOps—not its goal. RevOps is the oil that revs your revenue engine and gives it more mileage. Therefore, the alignment part is an ancillary outcome that takes place when you start optimizing your processes for revenue.

RevOps’ impact on north star metrics

Your north star metrics are usually the most accurate leading indicators of your long-term success. For example, a metric such as “number of trial users converting per week” might be a leading indicator of success. On the other hand, monthly recurring revenue (MRR) and average revenue per user (ARPU) are great metrics to measure your company’s current performance—but they are historic data that don’t necessarily tell you about the likelihood of future success.

To be a good north star, a metric must meet four important criteria:

- It should measure progress

- It should demonstrate customer value

- It should lead to revenue

- It should aggregate historical data with future potential

RevOps directly impacts your company’s north star metrics because—more often than not—revenue is your biggest north star metric. A recent survey from SiriusDecision found that companies that implemented strategies to improve their RevOps witnessed up to 36% more growth than the ones that didn’t. The survey also found that the publicly traded companies that used RevOps had their stock prices up by 71% than other firms in their category.

Therefore, revenue is the north star metric that helps you achieve all other north star metrics. That’s because revenue is the price your customers pay in return for the value—or a set of values—they get out of that price. Being able to deliver the value to the customers is usually your true north.

How to leverage Deal Intelligence to improve revenue operations

Revenue predictability is critical to building your revenue operations as it helps you allocate the right resources, assemble the right team and individuals to drive the desired outcome. But building predictable revenue is a tough nut to crack. Going by the recent estimates, 80% of companies in 2019 failed to exceed revenue goals while 38% of them fell short of meeting 90% of their goals.

To improve RevOps, you need a system that can diagnose current problems or highlight opportunities in your revenue pipeline and can give you insights to move a deal to closure.

This is where ‘Deal intelligence’ helps. It gives you visibility into the status and engagement level of all the deals in your pipeline and offers insights that can potentially help you get deals across the line.

What is deal intelligence?

The scope of deal intelligence isn’t just limited to analyzing sales and customer conversations but spans across capturing and analyzing activities across the stages of a deal.