How to run QBRs

A lot of customer success (CS) teams don’t leverage a quarterly business review (QBR) to its fullest potential. They use QBRs as a standard operating procedure to tell the customers how much money they have spent on the product, how long they have been with the brand, or when their next renewal is due.

These are basic metrics that customers can figure out on their own from within the product dashboard (or by asking their account manager). Asking them to sit through a 30-minute meeting to get a history and recap of their product engagement is frankly a wasted opportunity.

There are also other SaaS QBR trends that are equally underwhelming. For instance:

- Several customer success managers (CSMs) use QBRs as an excuse to upsell or cross-sell products or services to customers.

- And since customers don’t perceive a QBR to give them anything of great value, most of them use it as a forum to raise their complaints about the product or ask for feature requests that they want.

A better way to handle QBRs is to treat them as an exercise to improve your net revenue retention (NRR). QBRs are goldmines of opportunities for CS teams to understand the customers’ needs better, deepen customer relationships, and identify new avenues for account penetration.

For a QBR to be really effective, it needs to carry a value proposition—it has to have some amount of transformative data and insights that can help the customers understand how well (or poorly) they are solving their problems or how they can use some expert advice to get better outcomes.

In this post, we will walk you through a set of five tips that you can apply to run value-packed QBRs.

1. Show them the value

Your commitment to show customers the value of attending a QBR should be apparent right from the start—from the time you invite customers for a QBR meeting. You can do this by preparing a detailed meeting agenda that teases the customers with a few data and insights in relation to your product.

Communicate the value prop of a QBR meeting by outlining all the things that you want to address in the meeting so that the customers are encouraged to attend it and also come in with the right expectations. Instead of inviting them for a routine QBR meeting, give them an incentive to look forward to.

For example, instead of sending them a plain-vanilla email invite, craft your meeting agenda email to say something like:

I was looking at your data and it looks like you are using <xyz feature> 30% less than what the typical benchmark is.

If you use this feature to its optimal capacity, you can improve your deal close rate by 15%—just like some of our other customers.

In our upcoming QBR call, we can walk you through how to change that and help you drive better returns out of your investment.

When the actual QBR finally takes place, structure your QBR to focus on discussing how they can achieve relevant business-centric outcomes instead of making it a conversation around your product or services. For example, here’s how you can plan a QBR session to stick to the agenda’s promise and also to keep the meeting thoroughly engaging.

1. Account overview [1-2 minutes]

2. How the customers are using the product [5 minutes]

3. Interesting insights about the account [10 minutes]

4. Industry best practices to help them achieve their goals better [10 minutes]

5. Q&A [15 minutes]

Most customers will raise their hands and would be eager to sign-up the renewal contract if you can keep their interest in the QBRs and answer the critical what’s-in-it-for-me question.

2. Involve key people

A great way to clearly reinforce your product’s value up and down your customers’ organization chain is to invite the “key admin” in the QBR calls. This could be the decision-maker in the key account, a senior executive who can benefit from the data points you have in your QBR presentation, or a new leader who might have recently joined the customer company.

Sometimes, the senior executives might not have the time to sit through the entirety of a 45-minutes QBR meeting. Let’s say it’s a VP of Sales in the customer account who has a packed calendar, but they are also someone who oversees the metrics that your product offers to improve.

In such cases, draft a crisp one-pager content specifically designed to give them the highlight of the QBR meeting at a glance. If you know that they can’t attend the entire meeting, personalize the meeting to give them a gist of the QBR’s findings in the first 15 minutes. Make sure that the data you present is directly relevant to their role’s KPIs and includes actionable recommendations on how they can improve further.

There’s a strong business case to involve the key admin in the buyer side also when a CSM—responsible for a certain account—quits your organization. The key admin can act as a bridge between the account and the new CSM to keep the QBR conversation contextual and meaningful. And if there’s a change of guards on the customer side—it’s important that you involve key CS people from your side to make sure there’s no room for discrepancies.

Involving a key admin from the customer account helps you directly communicate your product’s value with the leadership and facilitate the internal buy-ins for upgrades and renewals. If you do a good job of communicating valuable insights that reinforces your product’s value in a fresh light (through these QBR meetings), you are not going to have any problem reeling in relevant people from the buyer account and getting approvals on new initiatives.

3. Position yourself as a strategic partner

Some customers may view customer success in the same light as customer support—perhaps with a bit of proactive check-ins thrown in the mix. That’s mostly because—in those cases—customer success is yet to differentiate itself from support by proving its critical role to the customers. And QBRs set the perfect stage for CSMs to change that.

Your CS team needs to leverage QBR to establish themselves as strategic partners in their business growth—not a vendor trying to sell them something or pass their complaints to the product team. CSMs should really own their relationship with the customers and make them feel that they are part of the company.

One way to build a strategic partnership with your customers is by giving them an early view of your product roadmap that adds value to their use cases.

If your product team has developed a feature that one of your customer accounts had requested —make it a highlight of the QBR call. Thank them for contributing to your product’s growth and map the feature’s relevance to their business requirements. This will help you bolster your trust with key customers, improve the feature adoption within an account, and position your brand as an ally in their growth.

4. Leave room for Q&A

QBR is not a one-way street—rather an interactive session to bridge the gap between your CS team and the customers. Once you give them a rundown of their business health (in relation to your product use), show them areas of improvement, and present a roadmap for the future—leave the floor open for them to ask questions that you might not have thought of.

This will give your CS teams plenty of other opportunities to close ranks with the customers. For instance, if customers express skepticism about a recommended course of action or an industry best practice—it’s an opportunity for you to explain the solution further and win their confidence.

If customers are eager to test out a new feature that you are planning to launch, it’s a clear indication that there’s room for you to grow your expansion revenue. But if customers show signs of confrontation because they haven’t achieved a lot from your product, it’s probably a churn signal that you should immediately act on.

At Avoma, our CS team uses Avoma’s tracking capability to capture phrases like “leadership change,” “champion left,” “change of direction,” “critical for operations,” or “in-house initiative” on these meetings which are generally potential churn indicators. You can set up a tracker to identify similar customer behaviour and take preemptive measures to stop the customer from churning.

5. Build a QBR playbook

Customer success is horses for the courses because they apply differently to companies that are at different stages of their growth. A lot of young startups and small businesses don’t even have a CS team to start with because they either haven’t figured out their product-market fit or don’t have a sustainable recurring revenue model. But if your business has matured into a solid money-generating machine, CS and QBRs should rank on top of your business priorities.

If your recurring revenue is through the roof, it usually means that you should have a scalable solution to run QBRs—and a playbook fits perfectly in your CS strategy. A playbook acts like a source of reference for your existing CSMs, improves new CSMs’ ramp-up time, and brings consistency to your CS operations.

A QBR playbook can also be the foundation of your CS operations as your business grows to the next level and needs a strategy revamp. In such situations, document all the best practices (ranging from smaller nuances to bigger observations) to build a comprehensive QBR playbook that everyone can refer to.

Update the playbook every now and then to add more insights or take out old hypotheses that don’t work anymore. Just make sure that you don’t attach yourself too much to processes and protocols because enforcing a lot of formal processes often kill innovative thinking.

Use QBRs to build strategic partnership with customers

QBRs are high returns investment that pays handsomely in the long run. If you can communicate its value upfront, build excitement around it, and position it as a strategic solution to your customers’ problem—you can easily use them as a fertile ground to improve upgrades, expansions, and renewals.

But a fair word of warning—never look at QBR only from the lens of generating additional revenue. A QBR is not a pitching session for CSMs to push for renewals or boast about their accomplishment. Your CS team should not underutilize it as a debriefing session between you and the customers.

Instead, make the most of a QBR session by offering your customers valuable data and actionable insights that will help them grow because your success eventually depends on how successful your customers are as a result of the partnership that they have with you.

What to do when a big account churns?

Like Harry Potter vs Lord Voldemort, SaaS and churn are fierce archnemeses. Potter represents life whereas the Dark Lord, death. New subscriptions give birth to new possibilities—churn mercilessly kills them.

But when you invent a ship, you also invent the shipwreck. SaaS and churn are two sides of the same coin. And no matter how good you are at tossing the coin, the odds are sometimes stacked against you.

If you pull up the industry stats, you will see that the average annual churn rate for smaller SaaS companies with less than $10M in revenue is about 20%. But even the best-in-class SaaS businesses have a churn rate of 5-7%. By every objective measure, it’s not that much of a big deal because it’s like losing a dollar $1 out of every $200 each month.

In SaaS, a big-scale churn is the definition of all hell breaking loose. Losing a few customers here and there is one thing—but what if a big account churns? It’s devastating.

Why churn matters

Acquisition vs retention is a hotly debated topic in SaaS circles, but there’s no denying that customer retention is the #1 source of revenue for most profitable companies. The graph below is one example of how retention typically impacts a SaaS company’s growth over time.

Churn is super concerning because most SaaS realize the compounding effect of net retention revenue (NRR) over a long time horizon. If you look closely, the graph above shows that there’s a 43% jump in retention revenue within just five years. It’s a crazy good reason to prevent churn at all costs if it means the NRR will get better with time.

But when a big churn takes place, it jolts your entire business. It demoralizes the spirit of everyone in the company—especially the customer success team because their performance is directly linked to the churn metric.

Of course, you can do a lot of things to prevent churn, but it will still happen. No amount of predictive AI tools, insights from customer success managers (CSMs), or new features can stop churn from happening. The sooner you embrace the fact about churn’s inevitability in your business, the better prepared you are to focus your energy in the right direction.

Late author and businessman Stephen Covey explains this kind of predicament in a concept he called circle of control vs circle of influence vs circle of concern:

In churn’s context, the circle of control includes everything that you can do within your capacity—hire talented people, invest more money and resources, rejig your internal processes, etc. If your churn analysis finds that customers are opting out of a certain plan because of the high subscription cost, for example, you can remediate it quickly by cutting down the price or by better communicating its value to your customers. It’s something you can directly control.

The circle of influence represents the actions you can take to potentially impact customer behavior. For instance—you can offer your customers discounts or other incentives, train your internal teams, and improve your customer marketing. It’s largely a safe bet—but it’s not as confident a move as the things you can do in your sphere of control.

As the circle widens, you will soon realize that there’s very little you can do about things that are beyond your control—and that is what makes up the circle of concern. Often, customers churn for reasons beyond your control, such as a change in the customers’ business environment or because they were bad-fit customers to start with.

Worry all you want but your concern might not take you anywhere except for spiraling down your team’s morale even further.

What to do when a big account churns

The first reaction is obviously to stop churn as soon as a customer breaks the news to you. Maybe you can offer incentives that can motivate them to reconsider the decision. Leave the offer out there for the customers to brood over without making your business look desperate about it.

But preventing churn is not always about the financial incentives—for you or the customers. Churn is also an opportunity for your business to learn how to improve your operations so that a failure of that scale doesn’t happen again. As a next step, put together a task force to carry out a regression analysis of the churn data and help your business avoid similar churn instances from repeating.

But if the damage is beyond repair, i.e., if the customers have made up their minds to break up and leave, there’s no point crying over spilled milk. Instead, here are five things you can do in the aftermath of a big churn to respond to the calamity in a way that’s mature, productive, and likely to avoid similar events from happening again.

1. Run an exit interview

If there’s one thing that you shouldn’t do when a customer bids farewell, don’t take it personally and maintain the composure that’s expected of a competent brand.

When someone wants to opt-out of your brand, you give them the kind of royal treatment they received when they became your customers for the first time. They deserve every bit of professional courtesy that you can extend to make the divorce less painful. That means your customer success team should schedule a formal interview to facilitate their exit process.

A well-structured exit interview helps you accomplish two critical things:

i. They avoid the customer from getting a bad aftertaste of leaving your brand

ii. They help you gather intel on the reasons that might have caused the churn

Customers who leave with a bitter experience are generally a bad omen for business. It usually comes back as karma in terms of negative reviews about your brand, bad press, or legal notices—if a particular customer’s experience has been the worst.

A thoughtful exit interview process can make your customers feel less guilty about leaving your brand or soften the blow if they hold any grudges against your brand. It’s an opportunity for you to own up to your mistakes, if any, or empathize with your customers—no matter their reason for leaving.

There’s some power in being honest, and customers will always see it if you boldly accept your failure. The experience might make them cherish their time and investment in your brand as a favorable experience.

It’s a standard norm for SaaS companies to run exit interviews through email or phone. But we would strongly advise you to schedule an in-person interview (if possible) or face-to-face video conferencing to make the most out of it. Most exit interviews over the phone or email require customers to check a set of boxes in a templatized form or answer simple Yes/No questions—which doesn’t tell you much about their rationale behind leaving your brand.

On the other hand, a face-to-face interview offers you a chance to read your customers’ body language, ask follow-up questions, and arrive at conclusive inferences, unlike interpreting vague data in the forms. If the customers give you clear signs that they are switching to a different vendor, for example, it helps your go-to-market (GTM) teams devise a tactical action plan to combat similar poaching in the future.

2. Share insights with everyone in your company

Customer conversations offer a treasure trove of data that everyone in your organization can benefit from. In the context of churn, giving everyone in your organization access to the customer insights gathered in the exit interview helps every team recognize the pitfalls that led to churn and acknowledge their roles in the process.

Here’s a likely scenario. Sales and marketing are usually the first teams to get in touch with the customers. And both the teams often do a great job of building excitement in customers during the deal negotiation stage—really selling them the upsides of using your product.

But when the customers sign the contract and start having a bad experience with your product or support team, the customer churns sooner than you expect.

This is exactly why exit interviews are critical: they give customers a forum to vent out their frustrations first-hand instead of broadcasting their negative experiences in a public forum.

But what’s more important is sharing the voice of customers (VoC) with everyone in the organization so that everybody has the same understanding about churn in hindsight. Call transcripts, meeting notes, all key customer conversations help you better understand the VoC and align every team.

Treat this process like a sales post-mortem, a debriefing opportunity for the involved teams to pinpoint what went wrong and what could you have been done to retain the customer for longer.

Churn can be a unifying tool to bring alignment across cross-functional teams. Organizing a dialogue between your marketing, sales, customer success, product, and engineering teams will drive sustainable change in the company and help you improve internal processes. Step it up by holding monthly or quarterly post-mortem recaps to discuss churn trends and address bottlenecks that might be stifling the customer experience.

We would recommend you to use a conversation intelligence software to record, transcribe, get summarized notes and analysis of all your churn conversations with the customer. More specifically, you can create snippets of key parts of these conversations and bring them to your team member’s attention.

You can go a step further and create a playlist of Churn Conversations and democratize it across your organization.

At Avoma, we have made it part of our process where people across the company can subscribe to these playlists. Everytime a new meeting or snippet is added to the playlist, all the subscribers are automatically notified via email.

3. Validate the churn data

When churn is caused for reasons you can control, for example, bad customer support, poor product experience—you can take immediate measures to avoid similar incidents from happening. But like we discussed earlier, a lot of times churn can happen due to reasons that are outside the sphere of your influence.

Regardless of what caused churn, you must address the problem and validate it with data.

Start by identifying customer accounts that are of the same size, same industry, and same contract value as that of the account that just churned. Let your customer success schedule a meeting with these accounts as part of the regular check-ins.

What’s important is that your CS team should try to tease out information from these top accounts to see if they share common pain points, friction, or complaints that the churning account reported in the exit interview.

We don’t recommend you share the news about a big account churning with them because it puts your brand in a bad light. The information is not relevant to them anyway—unless you have a strong reason to communicate such news in full transparency.

Talking to a couple of accounts will help you either validate the hypothesis that there is, indeed, a problematic pattern in your customer experience or discard the churn data as a one-off case that you couldn’t have stopped from happening.

4. Document churn signals

Even when you don’t find widespread churn behavior with other similar accounts, you should make it a practice to document possible churn signals that stood out in the data you gathered from the churned account.

Ask your customer success team if there were any warning bells in the way the customer behaved before they canceled their subscription? More often than not, at-risk customers exhibit one or more of the following behaviors that are tell-tale signals of an impending churn:

i. Declining product usage: It’s bad news when a customer gradually stops using your product or features.

ii. Delayed payments: When they default on their payment or delay their renewals repeatedly—it’s a big red flag.

iii. Behavior change: They will give subtle cues like canceling check-in meetings, not responding to your calls or emails, changing their communication style, etc.

iv. Pricing tier downgrades: Customers who downgrade their subscription plans are usually reconsidering your product or going through financial troubles internally.

v. Increased complaints: They start complaining about your price, products, or service quality.

vi. Poor ratings: They will give you low CSAT and NPS ratings or make excuses about participating in such surveys.

vii. Change of guards: Many times, churn happens when the leadership in the customer company changes.

If you can identify such behavior in customers who have churned, document such behavior patterns so that you can watch out for similar indicators in other at-risk accounts. Create playbooks and defined processes around quarterly business reviews (QBRs) so that the customer success team can take proactive steps to save churn from happening.

5. Focus on your best customers

You can’t be obsessed with a big-scale churn forever. At some point, you have to let it go to focus your teams’ energy and resources on other more important areas—namely, your best customers.

Yes, a big-ticket churn can be catastrophic to your revenue and employee morale. But most cases of churn are not as apocalyptic as it feels. In a post-churn event, your teams need to embrace a “growth mindset” and look at greener pastures in your business.

Most SaaS businesses earn about 70% of their revenue from 20% of their customers. Take stock of your happiest customers, pay attention to what’s working great for them, and double down on extrapolating the same experience to other smaller accounts with bigger revenue potential. Start by identifying your best accounts, build a key VIP account list, and create internal playbooks to offer them a more personalized, white-glove experience.

If your revenue has taken a severe blow due to the churn, identify alternative revenue channels to overcompensate for the loss. For instance, single out customer accounts in your monthly billing pipeline who recently gave you the highest scores in a recent NPS or CSAT test and encourage them to sign annual or multi-year contracts with your product.

But here’s a caveat—pushing customers to extend their subscription plan is a double-edged sword. It can backfire and lead to churn if you aren’t communicating the value of long-term contracts or offering them powerful incentives for doing so.

To fight churn, make NRR your best friend

Churns of significant magnitudes can rock your revenue pipeline and set you back by hundreds of thousands of dollars in recurring revenue. But churn can’t harm you if you focus your energy on just one key metric, i.e., the net revenue retention.

The average NRR benchmark across all SaaS businesses is around 100%—depending on the size of the annual contract value (ACV) that you can win. It can go up or down by 10-15% based on the market segment you operate in.

For instance, SaaS companies catering to SMBs generally have an average NRR of 90%, while enterprise SaaS has it at around 125%. Only a handful of outlier SaaS players like Snowflake can boast NRR earnings that beat the industry average. The NYSE-listed company recently reported an NRR of 178% (way more than the average in the enterprise SaaS space) and attributed their success to continued growth from our largest customers.

The takeaway here is—NRR is an antidote to churn. You don’t have to worry about churn killing your business if you can earn an NRR that matches or exceeds the industry average. On the other hand, if your NRR is below the industry standard—it’s likely going to be a death by a thousand cuts for your SaaS.

How to run check-in meetings?

There is a reason why car manufacturers strongly recommend that you regularly give your vehicle for periodic maintenance once every 12 months or after every 5,000 miles of driving. If you don’t—you run the risk of incurring engine malfunctions which usually turn out to be costlier than the periodic check-up costs.

Running a SaaS business is surprisingly similar to keeping your car running healthy. If you have a customer success team that regularly checks in with your customers, you will build a revenue engine that gives you great mileage and runs smoothly.

But if you don’t have a system to regularly check in with your customers, your relationship with them suffers and you will soon run into problems that can lead to a high degree of churn. There is, however, a huge difference between calling up your customers for a monthly check-in as a cursory gesture versus actually checking in with them to understand how they are doing.

Through this post, let’s look at how to run customer check-ins meaningfully.

Firstly, why should you run check-in meetings?

Regular check-ins with your customers are critical in helping your business deepen your customer relationships, align better to the workflow and goals of your customer, and identify potential growth opportunities.

A typical customer success check-in meeting is an opportunity to:

1. Understand how a customer uses your product

Customer check-in conversations are in some ways like a user research meeting. It’s the primary source of understanding product-customer fit, because these conversations are often show-and-tell sessions of how your product fits into the customer’s workflow, and gaps if any. These interactions help you understand how your customers are using your product, how happy (or sad) they are about it, or if they need any help along the way.

2. Identify expansion opportunities

Everybody likes a good follow-up—especially if they are paying customers of a SaaS business. Customers perceive regular check-ins as a sign of appreciation and care. Unlike the traditional form of customer service where customers are expected to contact the service desk and raise a support ticket, customer success check-in meetings offer a proactive and delightful customer experience that fosters deeper relationships.

And if you’re in SaaS, you know that with account management, your payback period comes down. That’s because, the longer a customer stays with you, the higher are your chances of account expansion.

3. Reduce churn

Customer churn has almost become synonymous with SaaS. One of the biggest reasons why customers churn is not because of feature parity, but because of unresolved problems and bad customer experience. For instance, it could be because of a lack of seamless sales to customer success handoff, where the Customer Success Manager (CSM) is not aware of the promises made by the account executive in the deal stage.

For starters, as a CSM, you need to be in the conversation loop across the sales cycle so everyone has enough context. By setting up a regular customer check-in cadence, you can start seeing potential churn signals much in advance and take action on time.

Running effective customer success check-in meetings

Customer success check-ins done to check off your to-do list isn’t of much help. How you conduct your check-in conversation matters. Based on our experience, we’ve put together four tips that will help you prepare and run your check-in meetings in an efficient and effective manner.

1. Having a clear agenda

Agendaless meetings are rookie mistakes that customer success teams—actually, every business team—should avoid like a plague. When meetings lack agenda, they have corresponding outcomes, i.e. they lack action.

Creating meeting agenda is not about scripting your entire meeting. Having an agenda can be as simple as having a structure to your conversation—a list of points you want to touch upon during the course of your conversation.

It typically can be a set of bullet points such as:

- Use case (how a customer is using your product)

- Feedback (their experience with your product)

- Pain point (any issues they might have)

- Positives (what they love about your product)

- Action items from the conversation

The ultimate purpose of setting an agenda for a check-in meeting is to be able to gather important information, without missing out on covering any topic.

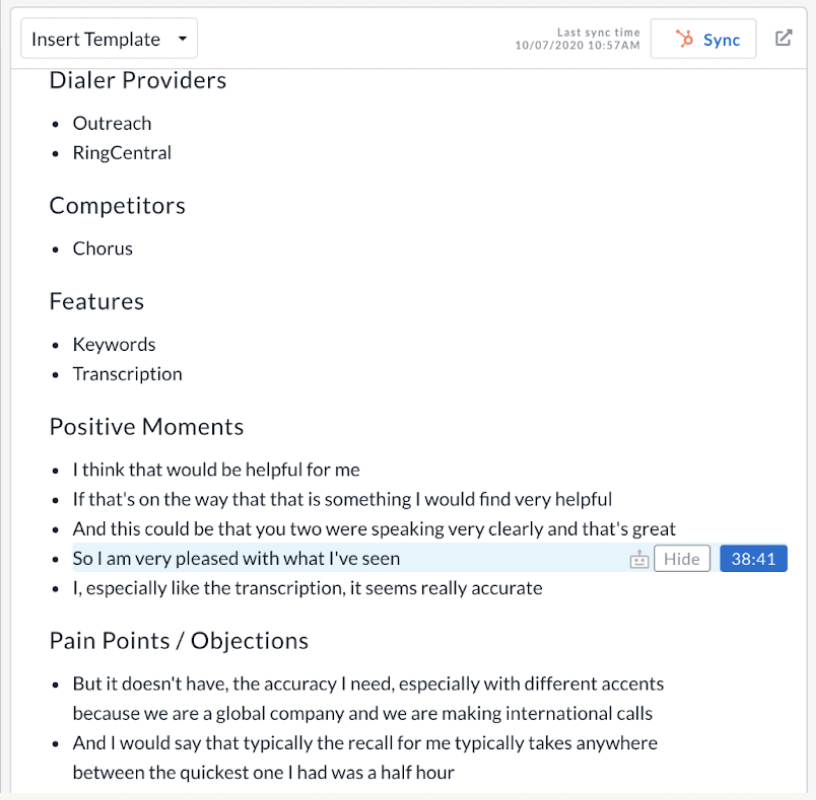

Here’s how a check-in template created on Avoma looks like:

Avoma’s conversation intelligence platform ensures that you can focus on the conversation, while the AI takes notes for you and smartly categorizes it under each of the bulleted topics (so that you needn’t be distracted from the conversation to take notes).

However, depending on how busy your schedule is—you are not going to be able to create a specific agenda for every check-in meeting. And that’s where Avoma really comes in handy. Based on your meeting purpose Avoma automatically assigns the right meeting agenda template to the right meeting, so that you can be ready for meetings in no time.

2. Share important updates

Exchanging important updates about each other is a great way to break the ice and jump straight to the point every time you get on a check-in call. We recommend you start every customer success check-in meeting on a positive note. For example, congratulate the customer for crossing an important milestone pertaining to their product usage or let them know about a new feature rollout that they had been asking for.

In addition to setting the tone for the entire meeting, this gesture will encourage the customer to really open up about their experience with your brand.

If you don’t have anything relevant to share with the customer, that’s ok. Don’t force superficial conversations for the sake of exchanging niceties. Instead, try to fill the void with information that can be useful in the future. For instance, ask the customers about the product experience so far, the highs and the lows of their journey with your product, or a suggestion that they can offer to improve the product’s offering.

Leveraging conversation intelligence can make this part of the check-in meetings really effective. If your team had used a conversation intelligence tool to record and analyze a previous check-in meeting—for example—you can refer to the highlights of that discussion as a conversation starter. Customers appreciate brands that offer contextual interactions that are personalized to their specific experiences.

3. Agree on upcoming meetings or goals

A customer check-in meeting is not a standalone event—it’s one of the several interactions in a series of engagements that your customer success team should have over an extended period of time. Therefore, every check-in meeting should be suffixed with a follow-up event—like agreeing to circle back about an issue or scheduling another meeting next month.

Agreeing on the next interaction also gives you a valid reason for you to contact your customer instead of spamming them with cursory check-ins. Instead of looking for a new excuse to get into your customers’ inbox, you can open a conversation loop by referring to an issue that the customers mentioned during one of the previous meetings.

Most importantly, aligning on the next meeting will keep your customer success team accountable about holding the next meeting and doing their homework before they get on the call. From the customers’ perspective, it’s a warm gesture that makes them feel valued and cared for.

As an extra measure, share the highlights of the meeting with your customer after each check-in to remind your customers of the meeting’s content. You can easily do this in Avoma by pulling out AI-generated summary Notes. These are essentially one-pager bulleted summaries of conversations that the AI automatically generates after each call.

The neat part is—these notes automatically sync to your CRM. Here’s how Notes (on the left half of the screenshot) appear on your Avoma dashboard alongside the full transcript (on the right half):

Share these Notes with your customers after a meeting is over and a few days before your next check-in to remind them of the topics that you discussed.

4. Monitor important insights and patterns

A power-packed meeting starts and ends on a high note. But a check-in meeting is rarely over when you hang up the call. Post-event analysis of a meeting is an equally important part of the meeting lifecycle so that you can curate actionable insights from it.

This is a stage where you collaborate with internal stakeholders to analyze the success of the meeting and prepare the next course of action. For example, CS leaders can take this opportunity to share feedback and coaching tips to CSMs to help them improve their on-call performance. Or, the CSMs can pass on relevant information from the meeting to the product team to help the latter prioritize the right product features.

5. Accelerate your workflow to solve problems quickly

Let’s say your customer talks about a set of product bugs they would like you to fix. You can save a lot of time without having to document their pain points and then raising a helpdesk ticket internally. Use Avoma to simply select the part of the conversation where the customer explains their problem, snip it, and share the crisp 20 or 30 seconds video with your engineering team to get it fixed.

In many ways, the actual job of a CSM begins where the check-in meeting ends because action speaks louder than words. Your customers might be signaling you to critical business information or product issues that you couldn’t stumble upon on your own. Active listening during every customer check-in call, and executing fast on the action items can make a world of difference to your business.

Final thoughts

Just like you wouldn’t wait for the check engine light to appear on your car’s dashboard, you shouldn’t wait for your customer relationships to falter to the point of churn to start running customer success check-in meetings.

Take proactive measures and set up formal processes to hold regular customer check-ins to avoid possible damages to your business growth. Tackling churn proactively is at the core of subscription business.

Let’s keep it going!

Identifying potential churn

If you’re in the SaaS business, it’s natural for you to worry about customer churn. Churn is what gives your customer success team fever chills, hurts your recurring revenue numbers, and anything beyond 5% will rock your company’s foundation.

But, can we leverage conversation intelligence to identify potential customer churn signals so that we improve our customer retention efforts? The short answer is yes, and this blog post explains how.

Let’s start with understanding the common reasons for customer churn.

Common reasons for customer churn

Customer churn is like the common cold —while everybody gets it at some point or another, some are more prone than others. The downside is—it’s hard to put a finger on something as a specific cause for customer churn. It’s usually a consequence of a set of things that may or may not be in your control.

Here are some common, addressable reasons for customer churn:

1. Poor product-customer fit

When customers sign up for your product, they usually have clear goals they want to achieve using your product. They will stick around if they get the results they want and abandon your ship if the investment on your product doesn’t justify their return on investment (ROI).

That said, sometimes we don’t realize poor-customer fit until it’s kinda late. For instance, it could be your brand and marketing hype that brought a customer on board, and this is where a thorough qualification process helps. You’re better-off listening to the early tell-tale signs of misfit than ignoring it for short-term gratification.

2. Sales-to-customer success account handoff experience

Sometimes, the reason for customer churn needn’t be your product or service, instead it could be a gap in terms of customer experience—for instance, it could be the way an account handoff happens from sales to customer success.

In absence of a proper transition from sales to customer success, customers can often feel like they are ignored or neglected. And when customers are not fully engaged with your brand, they don’t stick around for too long—hurting your customer lifetime value (CLV) and other key retention metrics.

3. Failing to meet customer expectations and poor service quality

In general, sales teams are filled with hard-charging, go-getter individuals. Their Type A personalities lead them to overperform, overdeliver, and sometimes over promise too. It’s the overpromises that later become a self-sabotaging factor for customer churn.

Take product roadmaps for example. Roadmaps at times are beyond everyone’s control—the product, engineering, marketing, or sales teams. And yet, sales reps often find themselves in tricky deal situations where customers ask them about certain features and the sales folks have to commit to it with a timeline. But we all know that new feature releases may or may not go as planned. And from a customer standpoint, that’s a mismatch between the promise and the outcome.

Poor customer service adds to the story. It also leads to a loss of $75 billion in business worldwide. Just for some perspective—that’s three times the ARR figure of Salesforce, the biggest SaaS giant.

4. Bad product experience

For product companies, launching new features and fixing bugs are two sides of the same coin. Updating an existing feature, for example, often leads to new technical snags that nobody expected. Having bugs is fine—as long as you’re committed to fixing them on time.

Product bugs are the viruses that can kill customer retention if you ignore them for too long. Studies show that about 14% of customers abandon brands due to bad product experiences.

Customers are usually forgiving of brands that listen to their bug reports and fix the problems ASAP. But the problem is, not all customers are forthcoming with bug reports. Also, a lot of product bugs go unreported or undetected.

The latter is probably the reason why the global market for bug bounty was valued at $223 million in 2020—projected to become a whopping $5465 million market by 2027! The takeaway here is—buggy products are exit doors for customer churn.

5. Cutthroat competition in your niche

While it’s easy to attribute customer churn squarely on the success team for failing to communicate your product’s value to the customer, it’s not always in their control to stop customers from falling through the cracks when they are constantly evaluating other options.

Buyers can sometimes fall for the shiny object syndrome—a phenomenon that draws people’s attention towards the latest trends, new products and offers. B2B buyers are no exception to this, and high customer churn is especially rabid in highly competitive niches like SaaS, media, and education.

The logic is pretty simple—the more options customers have, the more likely they are to switch for convenience factors like cost, features, and other benefits.

Leveraging Conversational Intelligence to tackle customer churn

Most customers don’t just wake up one day and decide to cancel your product subscription. As discussed above there are usually a set of reasons that eventually lead to a customer deciding to ultimately cancel your product subscription. And more often than not, there are leading indicators that signal potential customer churn which can be used to improve retention.

How to identify these signals?

Leveraging a customer intelligence software is a good starting point. A conversation intelligence software typically records, transcribes, and analyzes customer and prospect conversations. The software allows sales reps, account managers, and customer success managers to gain deeper visibility into their conversations and learn how to improve those conversations.

Using natural language processing (NLP), these platforms analyze conversations to identify topics discussed, talk patterns, questions asked, customer objections, sentiment, and more.

Using these insights, you can:

- Get visibility across all customer conversations to make data-driven decisions to improve their satisfaction and product adoption

- Proactively learn issues customers face, understand their expectations and prioritize your product roadmap accordingly

- Identify the talk patterns of your best CSMs to help improve upselling and cross-selling across the board

- Reduce customer onboarding time and improve productivity overall

Now, let’s look at how exactly you can leverage Conversation intelligence as a preventive measure to tackle customer churn.

1. Improving prospect qualification criteria

The job of sales is not just to close deals. They are also responsible to feel the customers’ pulse and offer them their honest advice. It all starts with asking the right qualification questions, running an effective discovery call to explore a mutual fit, and disqualifying prospects that don’t fit your bill.

Asking probing, open-ended questions will help the sales team avoid negative surprises later and also makes it easier on the customer success team to have enough context about the customer as they get onboarded. More importantly, keep your customer success manager (CSM) in the loop right through the deal stages.

As when you are in sales discovery mode, it helps to learn from previous customer conversations across sales, customer success, and customer support functions.

If you don’t have the time to listen to those entire conversations, you can go through the call summary notes and look for objections raised by customers, positive moments during the demo that a got a customer really excited, successful use cases (what problem was the customer trying to solve when they bought your product), etc.

In fact, we at Avoma,use the Jobs to Be Done framework across all our functions. It helps us set the right expectations with the customer by understanding what they are trying to accomplish with our product.

2. Identifying potential customer churn indicators

You know it’s important—but how exactly do you identify potential customer churn indicators? It’s hard, especially in today’s world of remote selling where you don’t have the luxury to read your customers’ micro-expressions.

Typically, CSMs are always on top of what’s happening with their accounts—are they actively using your product, is the number of support tickets going up or down, if the renewals are happening on time, etc.

That said, customer success sync up meetings can be a gold mine for you to understand potential customer churn indicators. For example, use Avoma to track usage of phrases like “leadership change,” “champion left,” “change of direction,” “critical for operations,” or “in-house initiative” on these meetings which can be potential churn indicators. You can set up a tracker to understand the most common reasons for customer churn in case of your product or service.

Further you can proactively set up alerts based to look for these phrases uttered by your customer. And that can help you proactively take preventive measures such as devising an account-based action plan to make your product contextually more relevant.

As a customer success leader, you can also search for those keywords across all customer success meetings and filter specifically for customer utterances and dive deep into those conversations for better context.

Make sure that you aren’t pinning your customer churn analysis based on recent behavior, but are looking at the account historically. If you look beyond the recency bias, you may be able to identify a pattern across the customer lifecycle historically, and improve your customer success process based on those learnings.

3. Democratizing account intelligence using playlists

Prospect and customer conversations are a treasure trove of account intelligence that everyone in your organization can benefit from. Like we discussed earlier, having access to intelligence from sales conversations can help customer success teams draw up suitable plans for retaining customers and expanding opportunities.

Conversation intelligence softwares helps you create playlists such as discovery calls, onboarding calls, etc. so that all the teams involved in the customer journey have enough context about the customer historically.

For example, the CSM gets to know every minute detail of how the sale went down. If the customer was originally planning to buy ten licenses of your product—but then discovered some internal issues and then finally decided to start with five licenses, the CSMs will be able to weave those points into their post-handoff upsell conversations at a later period.

Remember, from a customer perspective—they are interacting with one brand, and not several teams. Therefore, the experience needs to be seamless.

4. Using AI-assisted notes and transcripts to create seamless sales-customer success handoff

Sales is often the first point of contact for your customers. They do a pretty good job of building excitement in customers, giving them a high of your brand’s promises and product capabilities.

If a CSM takes over the customer account with enough knowledge transfer from sales, it creates a first-rate experience for customers.

Think of this process like an airline passenger onboarding a flight and getting a VIP treatment that they signed up for. If sales is the ground staff at the airport, the cabin crew are CS team members who can help customers settle in, upsell them on the various meal or entertainment services, and make the most of their in-flight experience.

Some of the most common hindrances, however, are the lack of proper documentation and CRM notes when the account handoff happens from sales to customer success. And eventually the miscommunication results in customer churn. And that’s where transcripts and AI generated call summary that gets auto-synced to the CRM comes in handy.

5. Being in sync with the voice of the customer

Call transcripts, meeting notes, all key customer data discussed until now help you understand the Voice of the customer (VoC) and be aligned with them. Being in sync with the VoC helps you understand what’s working with the existing customers and how your product and organization can be their extended partner to help them achieve their goals.

It helps to delegate VoC programs to all teams across your organization so that they can aggregate customer data from all possible touchpoints. You can create templates for each function to source key information. For example, sales and marketing can run focus group interviews, product teams can conduct user research interviews, and customer success teams can focus on customer satisfaction (CSAT) conversations.

Regular VoC programs can tip you off on potential red flags that customers are experiencing with your brand. Alternatively, they can also tell you who are your best customers and what they love about your brand so that you can focus more deeply on them to build lasting relationships.

They can also help you keep an eye on your competitors and focus on positioning your brand apart from the crowd—especially at the marketing and sales stages.

Final words on managing customer churn

Customer churn is an inevitable part of running a subscription business, and contributing to retention is part of everyone’s KPI. Focusing on customer retention and improving customer engagement improves your bottom line. There are two ways to fight churn: either be reactive and learn from your customer churn analysis to course-correct your processes or proactively identify the churn signals before they happen and prevent them from churning away.

Know your competition and your areas of improvement. More importantly, know what makes your customer happy and the positive moments your customers have with your product and brand.

Finally, track relevant KPIs that make sense to your business.