Product development projects always have very high opportunity cost. So, no matter who we are building for, we try to de-risk investments into projects by learning more about the problems before we invest time in solutions. How do you de-risk projects? An obvious answer may be to talk to customers, right? But it’s not that simple. Users of products are generally unreliable narrators of their own behaviors and preferences. How unreliable depends on who the customer is. For our consumer products, asking our consumers what they want is usually a lost cause. Sure, we can and should regularly talk to them about their problems, but we have to infer solutions ourselves. We can’t expect our consumers to be excellent product thinkers. If we did build what they asked for, they probably wouldn’t end up using it. As Henry Ford allegedly said, “If I’d asked customers what they wanted, they would have said a faster horse.”

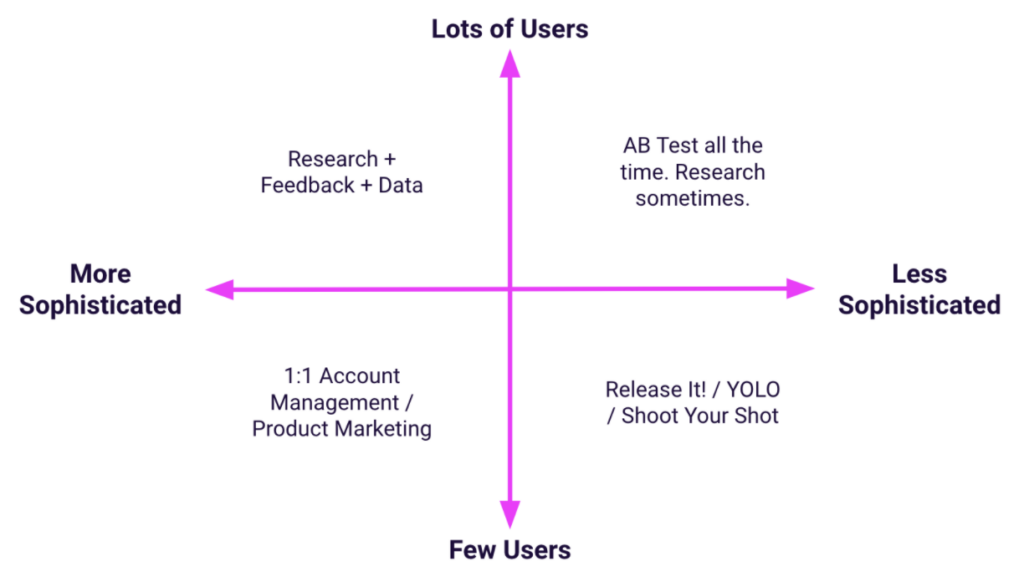

For event creators, it depends on how sophisticated they are. Eventbrite is a broad, horizontal platform used for many different types of events, from small meetups to large festivals and conferences and everything in between. For our most sophisticated customers (and most enterprise businesses), it’s not a bad approach to ask customers what they want, ask them to prioritize how bad they want it, and build and charge for things in that order. For less sophisticated customers, it’s still likely a bad idea. This ends up creating two spectrums to help you understand what to do by level of sophistication of the user vs. how much data users generate. Each of these quadrants tends to have a different approach to de-risking projects.

So what this implies is that our approach to de-risking projects should be very different depending on the type of customer we’re building for. Eventbrite isn’t Instagram, but we do have a lot of consumers compared to most companies. So, attendee experience projects are going to bias toward a data-first approach with research to back up the why when needed. They will also be the most likely to AB test. The self-service creator side of our business is more towards the middle of these axes. So we’ll blend some data and some research needed in addition to direct or proxy customer feedback. We also have segments of frequent creators that are smaller in number, but more sophisticated than the average self-service creator, so direct feedback plays more of a role in what we build, but it also has to be supported by data and user research. When we expanded our sales team into enterprise segments in the past, we were much more likely to build what they asked for.