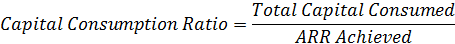

I first encountered this metric in the Key Banc Capital Markets, KBCM, (formerly Pacific Crest) SaaS Survey. The author, David Spitz, defines it as the total capital consumed, both equity and debt, to date divided by the ARR achieved at that date. Expressed as a formula gives,

It is essentially a way to track progress toward profitability and is most useful for late stage companies as they attain scale and approach profitability. You can see this use case in the KBCM survey data. The Capital Consumption Ratio shows a steady median ratio of 1.5x for companies with as little as $5M in ARR all the way to $75M. Additionally, the variance around the median declines as the ARR approaches $75M indicating that this metric does not provide an effective benchmark for companies with ARR less than $75M. The metric drops sharply to less than 1.0 for companies with ARR above $75M and this trend evidences scale in the business.