A SaaS metric used to measure a company’s sales efficiency using a ratio of New Subscription Revenue to Sales & Marketing (S&M) expense. Put another way, the Magic Number shows how much it costs to acquire $1.00 of subscription revenue. Any ratio above 1.0x means that your company generates more New Subscription Bookings than it spends to acquire the customer.

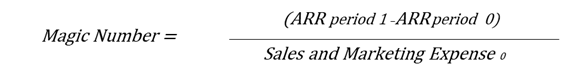

The most accepted formula is to use a ratio of the increase in ARR in the current period to the S&M expense in the prior period. The difference between the two periods should correspond to the length of the sale cycle. This is especially true for high growth, i.e. 3x annual ARR growth, companies. Investors’ expectations are that the Magic Number should fall within a narrow range around 1.0x with any ratio above 3.0x indicating a phenomenal operational leverage.

The Magic Number can be used for evaluating public companies with some adjustments. Public companies often do not publish their annual bookings numbers. Nor do they disclose the ARR at the end of the year, i.e. the Exit ARR. There are two ways in which to apply the Magic Number calculation if you do not have these two figures. Using year-over-year change in ARR, calculated using the subscription revenue in the fiscal fourth quarter and multiplying by four, will give a good proxy. As a reminder, the final quarter’s numbers will be found in the 10-K for that year, although you may need to subtract the first three quarters from the annual numbers to get to fiscal quarter subscription revenue. The second approach is even simpler. You take the year-over-year change in Subscription Revenue and divide it into the Sales and Marketing Expense for the prior year. Be sure to note the method used if you choose one of these two approaches.

The Magic Number often does not work well for Enterprise SaaS companies, especially in those below $50M in ARR. High variance in the length of the sales cycle, as measured by Average Days to Close, and wide variation among the Average Days to Close per opportunity make defining the “prior period” S&M expense difficult. Therefore, in such cases, we use the same period for comparison. The resulting metric is often referred as Sales Efficiency.